Top travel rewards cards that actually deliver value in 2025

Top travel rewards cards that actually deliver value in 2025

Last Updated: April 18, 2025

Let’s face it—travel isn’t getting any cheaper. Between rising airfares, hotel rate creep, and those sneaky resort fees, your vacation budget doesn’t stretch nearly as far as it used to. But here’s the thing most travelers miss: the right travel credit card can be your secret weapon, transforming everyday purchases into free flights, luxurious hotel stays, and perks that make you feel like a VIP without the celebrity price tag.

I’ve spent years analyzing the travel rewards landscape, test-driving dozens of cards, and learning the hard way which promises pan out and which fall flat. This comprehensive guide breaks down everything you need to know about travel credit cards in 2025—cutting through the marketing hype to reveal which cards actually deliver value for different types of travelers.

Whether you’re a frequent flyer hunting for business class upgrades or a casual vacationer looking to stretch your travel budget, you’ll find practical advice for choosing and maximizing travel cards that align with your actual travel patterns. No theoretical maximums or unrealistic strategies—just actionable insights for real travelers.

What Makes Travel Credit Cards Different from Regular Rewards Cards?

The fundamental differences between travel and standard rewards cards

The fundamental differences between travel and standard rewards cards

Travel credit cards aren’t just regular rewards cards with a picture of a beach on them. They’re specialized financial tools designed specifically for people who prioritize travel experiences over cash back or other rewards.

The Core Travel Card Difference

At their heart, travel credit cards operate on a simple premise: earn points or miles through everyday spending, then redeem those rewards for travel expenses. But unlike cash back cards with their predictable fixed values, travel points offer variable worth depending on how you use them—which is both their greatest strength and their most confusing feature.

What truly separates travel cards from standard rewards cards are three key elements:

- Travel-Focused Earning Structure: Higher reward rates on travel-related purchases like flights, hotels, rental cars, and sometimes dining and entertainment

- Travel-Centric Redemption Options: The ability to transfer points to airline and hotel partners, book through travel portals, or redeem for statement credits against travel purchases

- Travel-Specific Benefits Package: Perks designed specifically for travelers—things like airport lounge access, travel insurance protections, Global Entry/TSA PreCheck credits, and elite status with travel brands

These specialized features create opportunities for significantly more value than standard cash back cards—if you actually travel enough to use them.

The Various Types of Travel Cards You’ll Encounter

Not all travel cards are created equal. The market broadly divides into three main categories:

General Travel Rewards Cards

These flexible cards earn points that can be used across multiple airlines, hotels, and other travel providers. They’re not tied to any specific travel brand.

Key Characteristics:

- Points typically worth 1-1.5¢ each for direct travel bookings

- Often allow transfers to multiple airline and hotel partners

- Usually offer broader travel benefits rather than brand-specific perks

- Generally charge annual fees ranging from $95-$695

Perfect For: Travelers who value flexibility and aren’t loyal to specific airlines or hotels.

Examples: Chase Sapphire Preferred®, Capital One Venture X, American Express Gold Card

Airline Co-Branded Cards

These cards are partnerships between credit card issuers and specific airlines, earning miles in that airline’s frequent flyer program.

Key Characteristics:

- Earn miles directly in the airline’s loyalty program

- Offer airline-specific perks like free checked bags, priority boarding, and companion certificates

- Typically provide a pathway to elite status through spending

- Annual fees usually range from $95-$550

Perfect For: Frequent flyers who primarily use one airline or its alliance partners.

Examples: Delta SkyMiles® Gold American Express Card, United℠ Explorer Card, Southwest Rapid Rewards® Priority Card

Hotel Co-Branded Cards

Similar to airline cards, these are partnerships with specific hotel chains, earning points in the hotel’s loyalty program.

Key Characteristics:

- Earn points directly in the hotel’s loyalty program

- Provide hotel-specific benefits like automatic elite status, anniversary free nights, and on-property credits

- Often include pathways to higher elite status tiers

- Annual fees typically range from $95-$650

Perfect For: Travelers with strong hotel brand preferences or those who frequently stay at properties within a specific hotel family.

Examples: Marriott Bonvoy Boundless®, Hilton Honors American Express Surpass®, World of Hyatt Credit Card

The Major Upsides of Travel Cards (When Used Right)

When leveraged strategically, travel cards offer advantages that cash back cards simply can’t match:

1. Potentially Outsized Value

Unlike cash back’s fixed 1-2% return, travel points can deliver 2-5+ cents per point when redeemed optimally—particularly for premium cabins or luxury hotels. This means a single welcome bonus might be worth $1,000+ in travel value.

2. Access to Premium Experiences

Travel cards can unlock experiences that would otherwise be prohibitively expensive—like business class flights, luxury hotel stays, and exclusive airport lounges.

3. Comprehensive Travel Protections

Many premium travel cards include benefits like trip cancellation insurance, lost luggage reimbursement, rental car coverage, and emergency assistance services that would cost hundreds if purchased separately.

4. Status Acceleration

Several travel cards offer shortcuts to elite status with airlines and hotels, giving you perks like upgrades, late checkout, and priority service without meeting standard qualification requirements.

5. Global Acceptance and No Foreign Transaction Fees

Most travel-focused cards eliminate foreign transaction fees (typically 3%) and offer worldwide acceptance, making them ideal companions for international travel.

The Drawbacks You Should Know About

Travel cards aren’t perfect for everyone. Consider these potential downsides:

1. Higher Learning Curve

Maximizing travel cards requires more knowledge about loyalty programs, transfer partners, and redemption strategies than straightforward cash back cards.

2. Annual Fees

Most worthwhile travel cards charge annual fees ranging from $95 to $695, which must be offset by the benefits and rewards you actually use.

3. Points Valuation Complexity

Unlike cash back’s transparent value, travel points have variable worth depending on how they’re redeemed, making it harder to assess their true value.

4. Reward Devaluations

Travel loyalty programs can change their redemption rates with little notice, potentially reducing the value of points you’ve accumulated.

5. Temptation to Overspend

The pursuit of points and status can sometimes lead to unnecessary spending—defeating the financial purpose of having rewards cards.

The bottom line? Travel cards can deliver exceptional value, but only if you travel enough to utilize their benefits and are willing to learn how to maximize their rewards systems.

How to Choose the Right Travel Card for Your Specific Needs

Framework for choosing a travel card that matches your actual habits

Framework for choosing a travel card that matches your actual habits

With dozens of travel cards competing for your wallet space, finding your perfect match requires looking beyond flashy marketing to assess which card truly complements your travel patterns and preferences. Here’s a systematic approach to making the right choice.

Step 1: Know Your Travel Patterns (Be Brutally Honest)

Before getting seduced by luxurious perks or massive welcome bonuses, take a hard look at your actual travel habits:

- Travel frequency: How often do you realistically travel each year?

- Typical destinations: Domestic trips, international adventures, or a mix?

- Preferred airlines and hotels: Do you consistently use specific brands or book based on price?

- Travel style: Budget-conscious, mid-range, or luxury experiences?

- Booking behavior: Do you plan far ahead or make last-minute arrangements?

This honest assessment prevents the common mistake of choosing a card based on aspirational travel that rarely materializes. Remember—that premium card with lounge access offers zero value if you only fly once a year.

Step 2: Identify Your Priority Travel Benefits

Different travelers value different perks. Rank these common travel card benefits based on what matters most to you:

- Free flights/hotels: Maximizing reward earnings for free travel

- Flight benefits: Free checked bags, priority boarding, seat upgrades

- Hotel perks: Room upgrades, late checkout, free breakfast

- Airport comfort: Lounge access, expedited security

- Travel protections: Trip cancellation, delay coverage, lost luggage insurance

- Status acceleration: Faster path to elite status tiers

- Companion benefits: Free or discounted tickets for travel partners

This prioritization helps narrow your options to cards that excel in the areas you value most. A frequent solo business traveler might prioritize lounge access and upgrades, while a family might value free checked bags and trip protection.

Step 3: General Travel Card or Co-Branded?

This critical decision depends largely on your travel patterns and loyalty preferences:

Consider a General Travel Card If:

- You fly multiple airlines based on price and convenience

- You stay at different hotel chains rather than showing brand loyalty

- You value flexibility in how you redeem rewards

- You want to pool points from different spending for bigger redemptions

- You prefer simplified rewards that work across multiple travel providers

Consider a Co-Branded Card If:

- You consistently fly one airline or its alliance partners

- You regularly stay with a specific hotel chain

- You value brand-specific perks like free checked bags or annual hotel nights

- You’re working toward elite status with a particular travel company

- You already have a significant mileage/point balance with a specific program

Many experienced travelers eventually settle on a hybrid approach, holding both a flexible general travel card and one or more co-branded cards aligned with their most-used travel providers.

Step 4: Calculate Your Break-Even Point

Travel cards with annual fees must deliver enough value to justify their cost. Do this math before applying:

- Assign value to regular benefits you’ll actually use:

- Airport lounge access: $15-$50 per visit × expected visits

- Free checked bags: $30-$60 per bag × number of flights

- Annual free hotel nights: Typical cash cost of rooms you’d book

- Companion certificates: Cash value of a typical companion ticket

- Global Entry/TSA PreCheck: $20-$25 per year (amortized cost)

- Estimate annual rewards earning based on your typical spending:

- Regular spending × base earning rate

- Category bonuses × spending in those categories

- Subtract the annual fee from your total benefit value

For example, if a card offers benefits worth $325 and rewards worth $300 annually but charges a $95 fee, your net value is $530.

Step 5: Assess Welcome Bonus Value (With Realistic Eyes)

Welcome bonuses often provide the biggest single chunk of value from a new card, but evaluate them carefully:

- Determine the realistic value of the bonus based on your likely redemptions

- Confirm you can meet the spending requirement without stretching your budget

- Check eligibility restrictions like previous cardholder rules

- Consider timing for when you’ll want to use the bonus

A 100,000-point bonus sounds impressive, but if you can’t reasonably meet the $15,000 spending requirement, it’s worthless to you. Similarly, if restrictions prevent you from getting the bonus, the card’s ongoing value needs to stand on its own.

Step 6: Consider Your Overall Card Strategy

If you already have rewards cards, think about how a new travel card would complement your existing portfolio:

- Coverage gaps: Does the new card reward categories your current cards don’t?

- Point consolidation: Can points be combined with your existing programs?

- Benefit duplication: Are you paying for overlapping benefits across multiple cards?

- Credit impact: How might another application affect your credit profile?

- Management complexity: Can you realistically manage another card’s payment schedule and benefits?

Many successful strategies involve 2-3 complementary cards rather than a wallet full of redundant options.

Step 7: Think About Your Travel Future

Your ideal travel card may change as your life circumstances evolve:

- Career changes might increase or decrease business travel

- Family dynamics shift travel priorities and destinations

- Relocations might change your home airport and airline preferences

- Health considerations might affect travel frequency or style

- Financial situations influence your ability to manage annual fees

Choose a card that fits not just your current travel patterns but also your likely patterns for the next 1-2 years. If major life changes are on the horizon, consider shorter-term strategies or cards with more flexibility.

Top Travel Credit Cards Worth Considering in 2025

The cream of the crop in today’s travel rewards landscape

The cream of the crop in today’s travel rewards landscape

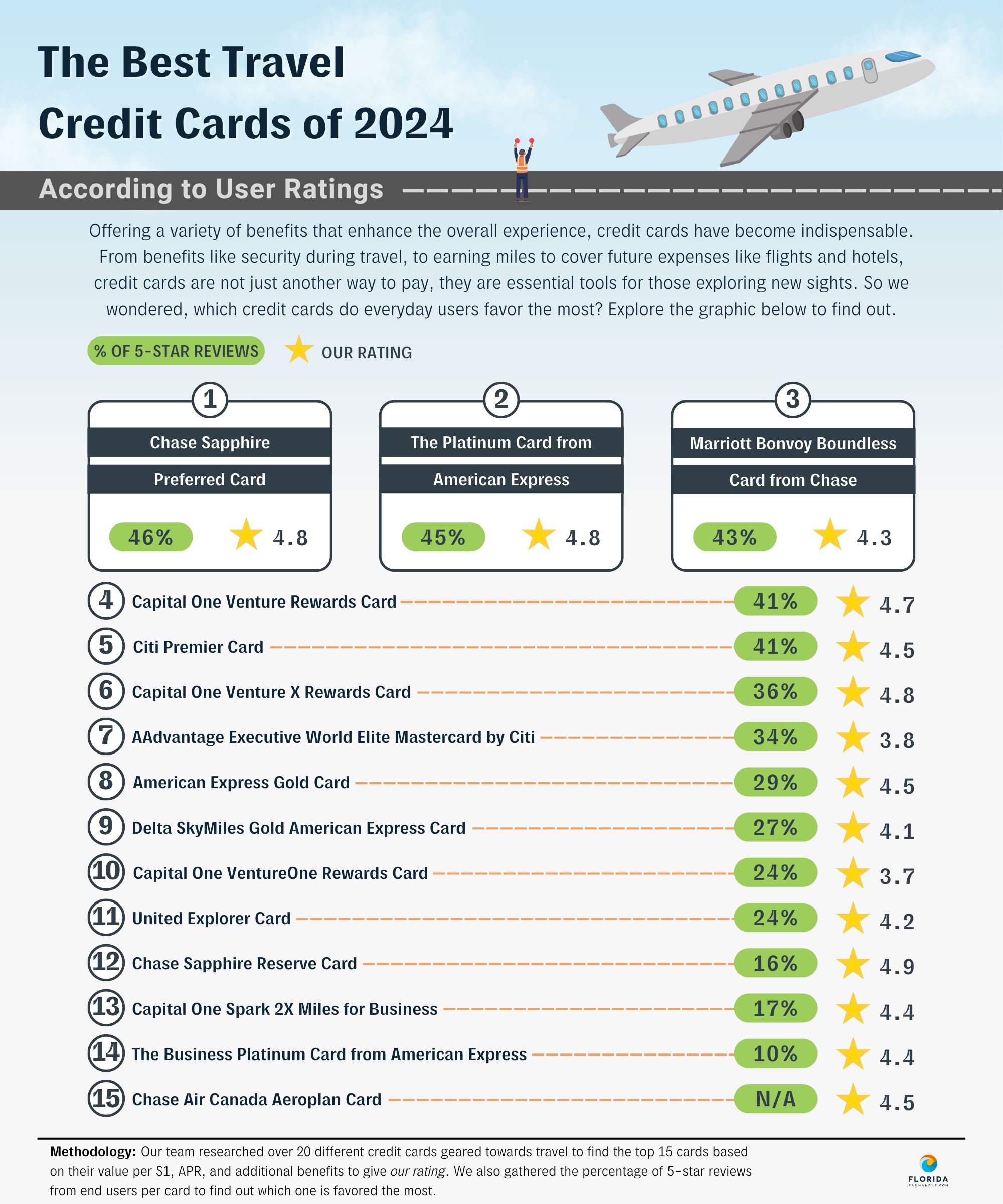

After evaluating dozens of travel cards based on rewards structures, benefits packages, annual fees, and typical redemption values, these cards stand out as the top contenders across different categories in 2025.

Best General Travel Rewards Cards

Chase Sapphire Preferred® Card: The Best All-Around Value

- Rewards Rate:

- 5x points on travel purchased through Chase Travel Portal

- 3x points on dining, select streaming services, and online groceries

- 2x points on all other travel purchases

- 1x point on everything else

- Annual Fee: $95

- Welcome Bonus: 75,000 points after spending $4,000 in first 3 months (worth $937+ in travel)

- Why It Shines:

- Points worth 25% more when redeemed through Chase Travel Portal

- Valuable 1:1 transfers to 14 airline and hotel partners

- Strong travel protection suite including primary rental car insurance

- Annual $50 hotel credit through Chase Travel Portal

- Perfect For: Value-conscious travelers who want premium benefits without a premium price tag

Capital One Venture X Rewards Card: The Premium Travel Package

- Rewards Rate:

- 10x miles on hotels and rental cars booked through Capital One Travel

- 5x miles on flights booked through Capital One Travel

- 2x miles on all other purchases

- Annual Fee: $395

- Welcome Bonus: 100,000 miles after spending $5,000 in first 6 months (worth $1,000+ in travel)

- Why It Shines:

- $300 annual travel credit for Capital One Travel bookings (effectively reducing fee to $95)

- 10,000 bonus miles every account anniversary (worth $100+)

- Unlimited access to Capital One Lounges and Priority Pass network

- Cell phone protection and comprehensive travel insurance

- Perfect For: Frequent travelers who can maximize premium benefits and travel credits

American Express Gold Card: The Foodie Traveler’s Dream

- Rewards Rate:

- 4x points at restaurants worldwide

- 4x points at U.S. supermarkets (up to $25,000 per year)

- 3x points on flights booked directly with airlines or through Amex Travel

- 1x point on all other purchases

- Annual Fee: $250

- Welcome Bonus: 80,000 points after spending $4,000 in first 6 months (worth $800-1,600 depending on redemption)

- Why It Shines:

- Up to $240 in annual credits ($10/month for dining, $10/month for Uber)

- Exceptional earning rates on food (both dining out and groceries)

- Valuable transfer partnerships with 20+ airlines and hotels

- No foreign transaction fees

- Perfect For: Travelers who spend heavily on dining and groceries and want flexible redemption options

Best Airline Credit Cards

Delta SkyMiles® Platinum American Express Card: The Delta Devotee’s Choice

- Rewards Rate:

- 3x miles on Delta purchases and direct hotel bookings

- 2x miles at restaurants and U.S. supermarkets

- 1x mile on all other purchases

- Annual Fee: $250

- Welcome Bonus: 75,000 miles after spending $3,000 in first 3 months

- Why It Shines:

- Annual companion certificate for domestic Main Cabin round-trip (worth $350-700)

- First checked bag free for you and up to 8 companions on same reservation

- 10,000 MQMs toward status after spending $25,000 in a calendar year

- 20% back on in-flight purchases

- Perfect For: Delta loyalists who take at least 2-3 trips annually on the airline

United℠ Explorer Card: The United Flyer’s Best Friend

- Rewards Rate:

- 2x miles on United purchases, dining, and hotels

- 1x mile on all other purchases

- Annual Fee: $95 (waived first year)

- Welcome Bonus: 60,000 miles after spending $3,000 in first 3 months

- Why It Shines:

- First checked bag free for you and one companion

- Two one-time United Club passes each year

- Priority boarding and 25% back on in-flight purchases

- Global Entry/TSA PreCheck credit (up to $100)

- Perfect For: Occasional United flyers who want elite-like benefits without high fees

Southwest Rapid Rewards® Priority Card: The Southwest Specialist

- Rewards Rate:

- 3x points on Southwest purchases

- 2x points on local transit, internet/cable/phone services, and select streaming

- 1x point on all other purchases

- Annual Fee: $149

- Welcome Bonus: 50,000 points after spending $3,000 in first 3 months

- Why It Shines:

- 7,500 anniversary points each year (worth about $105)

- $75 annual Southwest travel credit

- Four upgraded boardings per year (worth $30-50 each)

- Points count toward coveted Companion Pass

- Perfect For: Southwest regulars who value the carrier’s unique benefits and Companion Pass

Best Hotel Credit Cards

World of Hyatt Credit Card: The Hotel Sweet Spot

- Rewards Rate:

- 4x points at Hyatt properties

- 2x points on dining, airlines, local transit, gym memberships

- 1x point on all other purchases

- Annual Fee: $95

- Welcome Bonus: Up to 65,000 points (30,000 after $3,000 spend in 3 months, plus up to 35,000 more by earning 2 bonus points per $1 on purchases that normally earn 1 point, on up to $17,500 spent in first 6 months)

- Why It Shines:

- Free night certificate annually at Category 1-4 properties (worth $200-350)

- Automatic Discoverist status with pathway to higher tiers

- 5 qualifying night credits annually plus 2 more for every $5,000 spent

- No foreign transaction fees

- Perfect For: Travelers who appreciate Hyatt’s smaller but high-quality footprint and strong redemption values

Marriott Bonvoy Boundless® Credit Card: The Marriott Maximizer

- Rewards Rate:

- 6x points at Marriott Bonvoy properties

- 3x points on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining

- 2x points on all other purchases

- Annual Fee: $95

- Welcome Bonus: 3 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 in first 3 months

- Why It Shines:

- Free night award annually (worth up to 50,000 points)

- Automatic Silver Elite status with pathway to Gold

- 15 Elite Night Credits annually

- No foreign transaction fees

- Perfect For: Travelers who value Marriott’s massive global footprint and want to accelerate elite status

Hilton Honors American Express Surpass® Card: The Hilton High-Earner

- Rewards Rate:

- 12x points at Hilton properties

- 6x points at U.S. restaurants, U.S. supermarkets, and U.S. gas stations

- 3x points on all other purchases

- Annual Fee: $95

- Welcome Bonus: 150,000 Hilton Honors points after spending $3,000 in first 3 months

- Why It Shines:

- Automatic Hilton Gold status (includes breakfast, room upgrades, points bonus)

- Weekend night reward after spending $15,000 in a calendar year

- 10 Priority Pass airport lounge visits annually

- No foreign transaction fees

- Perfect For: Hilton enthusiasts who value Gold status benefits and strong earning rates

Best No-Annual-Fee Travel Cards

Capital One VentureOne Rewards Credit Card: The Fee-Free Flexible Option

- Rewards Rate:

- 5x miles on hotels and rental cars booked through Capital One Travel

- 1.25x miles on all other purchases

- Annual Fee: $0

- Welcome Bonus: 20,000 miles after spending $500 in first 3 months

- Why It Shines:

- No annual fee but still offers transfer partners

- Solid 1.25x earning rate on all purchases

- No foreign transaction fees

- 0% intro APR on purchases for 15 months

- Perfect For: Occasional travelers who want travel flexibility without annual costs

Bank of America® Travel Rewards Credit Card: The Relationship Booster

- Rewards Rate:

- 1.5 points per dollar on all purchases

- 25%-75% points bonus for Bank of America Preferred Rewards members

- Annual Fee: $0

- Welcome Bonus: 25,000 points after spending $1,000 in first 90 days

- Why It Shines:

- No annual fee and no foreign transaction fees

- Points worth 1 cent each for travel statement credits

- Relationship bonus can boost earning to 2.62 points per dollar

- 0% intro APR on purchases for 15 billing cycles

- Perfect For: Bank of America customers (especially Preferred Rewards members) looking for easy travel redemptions

Discover it® Miles: The First-Year Doubler

- Rewards Rate:

- 1.5 miles per dollar on all purchases

- Miles Match® (all miles earned in first year are doubled)

- Annual Fee: $0

- Welcome Bonus: Miles Match® (effectively doubles your first-year earnings)

- Why It Shines:

- First-year match makes effective earning rate 3% on everything

- Extreme redemption flexibility (travel, cash back, gift cards)

- No foreign transaction fees

- No minimum redemption amount

- Perfect For: First-time travel cardholders who want maximum value and simplicity in year one

Mastering the Art of Travel Points: How to Extract Maximum Value

Strategic approaches to squeeze more value from your travel rewards

Strategic approaches to squeeze more value from your travel rewards

The real magic of travel cards happens not just in earning points, but in how you strategically redeem them. With the right knowledge, you can extract significantly more value from your travel rewards than their nominal cash equivalent.

Understanding Point Values: The Basics

Before diving into advanced strategies, grasp this fundamental concept: the value of travel points varies dramatically based on how you redeem them.

As a rule of thumb, here’s what points are typically worth across different redemption options:

- Statement credits: Often the lowest value at 0.5-1.0 cents per point

- Gift cards: Usually 0.7-1.1 cents per point

- Travel portal bookings: Around 1.0-1.5 cents per point

- Transfer to airline/hotel partners: The highest potential at 1.0-5.0+ cents per point

- Merchandise: Generally terrible value at 0.3-0.8 cents per point

This variance explains why two people with identical cards and point balances can extract dramatically different value—it’s all about how you use them.

Transfer Partner Magic: The Ultimate Value Hack

The highest-value redemptions typically come from transferring points to airline and hotel partners, particularly for premium experiences. Here’s how to make this work:

- Understand transfer ratios: Most programs transfer at 1:1, but some offer bonuses or have different ratios

- Learn sweet spots in partner award charts: Every loyalty program has particular routes or properties where points stretch furthest

- Watch for transfer bonuses: Issuers occasionally offer 20-40% bonuses when transferring to specific partners

- Consider aspirational redemptions: Business and first-class flights often deliver 3-5+ cents per point in value

Example value comparison:

- 100,000 Chase Ultimate Rewards points as cash back: $1,000

- Same points transferred to United for business class to Europe: $4,000+ value (4+ cents per point)

This difference explains why serious points maximizers focus so heavily on strategic transfers.

The Redemption Sweet Spots Worth Targeting

Every rewards program has particular redemptions that offer outsized value. Here are some perennial favorites:

Airline Transfer Sweet Spots:

- Virgin Atlantic for Delta One to Europe: 50,000 points vs. $5,000+ cash price

- ANA Round-the-World in Business Class: 115,000 points for multiple stops across continents

- Singapore Airlines First Class Suites: One of the few ways to book this ultra-premium product

- Flying Blue Promo Rewards: Discounted award tickets between North America and Europe

- British Airways for Short-Haul Partner Flights: Distance-based chart offers great value on shorter routes

Hotel Transfer Sweet Spots:

- Hyatt Category 1-4 Properties: Often deliver 2-3 cents per point in value

- Marriott 5th Night Free on Award Stays: Effectively 20% discount on longer stays

- Hilton Premium Room Rewards: Sometimes better value than standard room bookings

- IHG PointBreaks Promotions: Heavily discounted award nights at select properties

Learning these sweet spots in programs that match your travel preferences can dramatically increase your effective return from travel cards.

Travel Portal Strategies: When Direct Booking Makes Sense

While transfers often provide maximum value, sometimes booking directly through your card’s travel portal is smarter:

- When cash prices are low: During sales or off-peak times, portal bookings may require fewer points

- When you need earning and elite benefits: Bookings through issuer portals often qualify for airline miles and status credit

- When you have redemption bonuses: Cards like Chase Sapphire Reserve® give 50% more value when redeeming through their portal

- When availability through partners is limited: Portal bookings access the same inventory as cash bookings

- When you value simplicity: Portal bookings avoid the complexity of navigating transfer partners

For example, a $500 economy flight might cost 40,000 points through a transfer partner but only 33,333 points through the Chase portal with a Sapphire Reserve® (at 1.5 cents per point).

Points Pooling: The Family and Friend Multiplier

Many programs allow combining points with others, creating opportunities to reach redemption thresholds faster:

- Household pooling: Programs like Chase, American Express, and Capital One allow point transfers to household members

- Authorized user sharing: Points earned by authorized users typically pool with the primary account

- Referral bonuses: Earn additional points by referring friends and family to your favorite cards

- Transferring to others’ loyalty accounts: Some programs allow point transfers to anyone’s airline or hotel account

These pooling options are particularly valuable for families or couples working together toward a shared redemption goal.

Timing Matters: When to Earn and When to Burn

Strategic timing can significantly impact your points’ value:

- Earning timing:

- Apply for cards before major spending periods

- Time applications around best-ever welcome bonuses

- Consider applications before anticipated travel booking needs

- Burning timing:

- Book far in advance for best award availability

- Or look for last-minute award space that often opens up

- Redeem before announced program devaluations

- Book during seasonal sweet spots (like shoulder seasons)

- Program-specific timing:

- Use Amex Membership Rewards when transfer bonuses are active

- Book United awards close to departure when they often release premium cabin seats

- Look for seasonal hotel award availability patterns

The adage “earn and burn” has merit—points generally don’t increase in value over time, and the risk of devaluation is real.

Advanced Card Combination Strategies

Experienced travelers often use multiple complementary cards to maximize returns across different spending categories and travel needs:

The Chase Trifecta:

- Chase Sapphire Reserve® or Preferred®: For travel, dining, and point transfers

- Chase Freedom Flex℠: For rotating 5x categories

- Chase Freedom Unlimited®: For 1.5x on non-bonus spending

All these cards earn Ultimate Rewards points that can be combined in your premium card account for maximum value.

The Amex Travel Quartet:

- The Platinum Card®: For flights, premium travel benefits

- American Express Gold Card: For dining and U.S. groceries

- American Express Green Card: For broader travel and transit

- Blue Business Plus™: For 2x on general spending up to $50,000 annually

This combination covers nearly all spending categories with bonus earning rates while providing comprehensive travel benefits.

The Multi-Program Approach:

- Capital One Venture X: For general travel and 2x on everything

- American Express Gold Card: For dining and groceries

- Citi Premier® Card: For gas stations and other categories

- Chase Sapphire Preferred®: For Ultimate Rewards transfer partners

This approach gives access to all major transferable points currencies and their unique partner ecosystems.

Avoiding Common Points Mistakes

Finally, be aware of these common pitfalls that erode point value:

- Redeeming for merchandise: Almost always terrible value compared to travel

- Letting points expire: Always track expiration dates and keep accounts active

- Ignoring transfer bonuses: These can boost value by 20-40% with proper timing

- Point hoarding: Accumulating massive balances increases devaluation risk

- Chasing status unnecessarily: Sometimes paying for benefits directly is cheaper than spending for status

- Overlooking opportunity costs: Consider what you could earn with a different card for the same spending

Remember: the goal isn’t to accumulate the most points, but to get the most value from the points you earn through strategic redemptions that align with your actual travel goals.

Travel Cards vs. Cash Back: Which Actually Delivers More Value?

:max_bytes(150000):strip_icc()/4230530_final-691192e3e2a04cf5be496ce51d664ff2.png) The honest comparison between travel and cash back rewards

The honest comparison between travel and cash back rewards

The travel card versus cash back debate isn’t just about math—it’s about aligning your rewards strategy with your lifestyle and preferences. This honest comparison will help you determine which approach truly delivers more value for your specific situation.

The Value Proposition Face-Off

Let’s start with the fundamental value differences:

Travel Cards Potential Value:

- Earning rates: Typically 1-5x points on purchases

- Point values: Variable, ranging from 1-5+ cents per point depending on redemption

- Effective return: Potentially 1-15%+ on spending when maximized

- Redemption flexibility: More limited, focused on travel

Cash Back Cards Potential Value:

- Earning rates: Typically 1-5% cash back on purchases

- Cash value: Fixed at 1 cent per percentage point

- Effective return: Consistently 1-5% on spending

- Redemption flexibility: Unlimited, cash works for anything

The key takeaway? Travel cards offer higher potential value but with more variability and complexity, while cash back provides lower but guaranteed returns with maximum flexibility.

When Travel Cards Legitimately Win

Travel cards pull ahead in these specific scenarios:

1. You Travel Frequently

If you take 3+ trips annually, travel cards often deliver substantially more value through both rewards and built-in benefits like free checked bags, priority boarding, or hotel status.

Value Example: A frequent Delta flyer with the Delta SkyMiles® Platinum card saves $60 in checked bag fees round-trip. Over four annual trips, that’s $240 in value—already exceeding the card’s $250 annual fee before counting any points earned or other benefits.

2. You Redeem for Premium Travel

Business and first-class flights or luxury hotels often deliver 3-5+ cents per point in value, far exceeding what cash back can provide.

Value Example: A business class ticket to Europe might cost $4,500 or 120,000 Ultimate Rewards points transferred to United. That’s 3.75 cents per point—a return impossible with cash back cards.

3. You Value Specific Travel Benefits

Some travel perks—like airport lounge access, hotel elite status, or comprehensive travel insurance—are difficult to purchase separately and can significantly enhance your travel experience.

Value Example: The Capital One Venture X includes Priority Pass and Capital One Lounge access. Purchased separately, comparable lounge membership would cost $429+ annually, already exceeding the card’s $395 fee before considering any points or other benefits.

4. You’re Planning an Aspirational Trip

If you’re saving for a specific dream vacation, travel cards can make luxury experiences accessible that would otherwise be financially out of reach.

Value Example: A five-night stay at the Waldorf Astoria Maldives might cost $5,000+ or 480,000 Hilton points earned through a combination of card spending and bonuses. This creates access to experiences that might otherwise be unattainable.

5. You Have Flexible Travel Plans

If you can adjust your travel dates and destinations based on award availability, you’ll consistently extract more value from travel cards.

Value Example: Being able to travel during off-peak times might mean using 45,000 points for a flight instead of 80,000 during peak periods—effectively increasing your points’ value by nearly 80%.

When Cash Back Legitimately Wins

Cash back cards are genuinely superior in these circumstances:

1. You Travel Infrequently

If you take one trip or less annually, you’ll struggle to offset annual fees and fully utilize travel-specific benefits like lounge access or free checked bags.

Value Example: A $95 annual fee travel card might offer excellent theoretical value, but if you never use the travel benefits, a no-annual-fee 2% cash back card actually delivers better returns.

2. You Prefer Budget Travel

If you typically book economy flights and budget accommodations, the redemption value of travel points is often limited to 1-1.5 cents per point—similar to cash back rates.

Value Example: Using 25,000 points for a $300 economy flight yields 1.2 cents per point in value. A 2% cash back card would earn $240 on $12,000 spending (enough to earn those 25,000 points at a 2x rate), while having complete flexibility on how to use those funds.

3. You Value Ultimate Flexibility

Cash rewards can be used for anything—travel, emergencies, investments, or everyday expenses—without redemption restrictions or program rules.

Value Example: When unexpected expenses arise, having $500 in cash back provides immediate flexibility, while $500 worth of travel points might sit unused until your next trip.

4. You Don’t Want the Mental Overhead

Maximizing travel cards requires learning loyalty programs, tracking transfer partners, and monitoring award availability—time and energy not everyone wants to invest.

Value Example: The difference between optimal and suboptimal redemptions can be substantial. Without the time to research, you might get only 1-1.2 cents per point in value—less than a simple 2% cash back card would provide.

5. You’re Debt-Averse or Budget-Conscious

Cash back provides immediate value that can offset your statement balance, while travel rewards are typically realized months or years later when you book travel.

Value Example: $100 in cash back can reduce this month’s bill immediately, while $100 worth of travel value might not be realized until you take a trip next year.

An Honest Value Comparison: By the Numbers

Let’s compare the annual value from a premium travel card versus a premium cash back card for someone spending $25,000 annually:

Capital One Venture X ($395 annual fee):

- $10,000 on travel through Capital One (10x): 100,000 miles worth $1,000-$1,500+

- $15,000 on everyday purchases (2x): 30,000 miles worth $300-$450+

- $300 annual travel credit (assuming full use)

- 10,000 anniversary miles worth $100+

- Lounge access valued at $300+ (if used 6+ times annually)

- Total value: $1,305-$2,055+ minus $395 fee = $910-$1,660+ net value

- But if you don’t use the travel credit or lounge access, value drops significantly

Blue Cash Preferred® ($95 annual fee):

- $6,000 on groceries (6%): $360

- $3,000 on gas and transit (3%): $90

- $16,000 on other purchases (1%): $160

- Total value: $610 minus $95 fee = $515 net value

- Value is consistent regardless of redemption choices

This comparison illustrates the key difference: travel cards offer higher potential value but require maximizing specific benefits and redemption opportunities, while cash back delivers reliable returns with minimal effort.

The Practical Middle Ground: The Hybrid Approach

Many experienced rewards maximizers settle on a balanced strategy that leverages both card types:

- Travel cards for travel spending: Use travel-focused cards for actual travel purchases to earn bonus points and access benefits like trip protection and free bags

- Cash back for everyday expenses: Use strong cash back cards for routine spending categories where travel cards don’t offer bonuses

- Strategic welcome bonuses: Apply for travel cards with valuable welcome bonuses when planning specific trips, then reassess after the first year

- Annual benefit utilization: Set calendar reminders to ensure you’re using all travel card benefits that offset annual fees

This hybrid approach provides the best of both worlds: premium travel benefits when you actually travel, plus reliable cash back for everyday spending.

The Bottom Line: Honest Self-Assessment

The most valuable rewards strategy isn’t necessarily the one with the highest theoretical return—it’s the one you’ll actually implement consistently based on your real spending patterns and travel habits.

If you love learning loyalty programs, plan trips strategically, and travel regularly, travel cards will likely deliver substantially more value. If you prefer simplicity, travel sporadically, or prioritize flexibility, cash back may be your better match.

Remember: the “best” card is the one that aligns with your lifestyle, not the one with the flashiest marketing or biggest theoretical return.

Maximizing Travel Card Benefits Beyond Just the Points

Getting full value from travel card perks and protections

Getting full value from travel card perks and protections

While points and miles grab the headlines, premium travel cards include an array of valuable benefits that often go underutilized. Mastering these perks can dramatically increase your card’s value—sometimes exceeding the worth of the points themselves.

Airport Experience Enhancers

Airport Lounge Access: Your Sanctuary from the Terminal Chaos

Premium travel cards often include lounge access that transforms your pre-flight experience:

- Priority Pass membership: Access to 1,300+ lounges worldwide (valued at $429 annually)

- Proprietary lounges: Exclusive spaces like Amex Centurion Lounges, Capital One Lounges, or Chase Sapphire Lounges

- Airline-specific lounges: Access through co-branded cards or when flying the affiliated airline

Maximization tip: Download the lounge network app to find available lounges, check operating hours, and understand guest policies. Remember that some cards allow free guests while others charge $27-50 per guest.

Expedited Security Programs: Skipping the Line

Many premium cards reimburse application fees for these time-saving programs:

- Global Entry: Expedited U.S. customs processing plus TSA PreCheck benefits ($100 every 5 years)

- TSA PreCheck: Faster domestic security screening with no shoe removal or electronics separation ($85 every 5 years)

- CLEAR: Biometric identity verification to skip document checking lines ($189 annually)

Maximization tip: Apply for Global Entry rather than TSA PreCheck alone, as it includes PreCheck benefits plus international advantages. Schedule your renewal application up to 12 months before expiration to maximize the reimbursement timing.

Flight Benefits Worth Hundreds

Free Checked Bags: The Sneaky Money-Saver

Co-branded airline cards typically offer first checked bag free for you and sometimes companions:

- Value per flight: $30-60 per bag each way

- Annual value: $240-480 for a traveler taking 4 round-trips annually

- Family value: Cards that extend benefits to companions can save $1,000+ annually for a family of four

Maximization tip: You generally don’t need to purchase the flight with your affiliated card to receive free bags—having the card and including your loyalty number in the reservation is typically sufficient.

Priority Boarding: More Than Just Status

Early boarding access provides practical benefits beyond ego satisfaction:

- Guaranteed overhead space: Avoid gate-checking your carry-on

- Settlement time: More relaxed boarding experience

- Seat selection advantage: Better chance at preferred seats for airlines with open seating

Maximization tip: Even when traveling on basic economy fares that typically board last, your card-provided priority boarding often still applies, offsetting one of basic economy’s major downsides.

Companion Certificates: The Hidden Jackpot

Several airline cards offer annual companion certificates that can exceed the annual fee in value with a single use:

- Delta companion certificate: Valid for domestic round-trip flights

- Alaska companion fare: $99 plus taxes/fees for a companion on any Alaska Airlines flight

- Southwest Companion Pass: Allows designated companion to fly free on all flights (earned through qualifying activity)

Maximization tip: Use companion certificates on expensive routes during peak travel periods to maximize value, and remember that most certificates have booking class restrictions.

Hotel Perks That Upgrade Your Stay

Elite Status: VIP Treatment Without the Qualifying Nights

Many hotel cards provide automatic elite status that would otherwise require 25+ nights annually:

- Hilton Gold/Diamond: Includes free breakfast, room upgrades, late checkout

- Marriott Gold/Platinum: Includes welcome gifts, enhanced internet, late checkout

- Hyatt Discoverist/Explorist: Includes premium internet, bottled water, preferred rooms

Maximization tip: Once you have status through a card, contact hotels directly before arrival to note your status and politely request any available upgrades or enhancements.

Free Night Certificates: The Annual Fee Justifier

Hotel cards commonly offer anniversary free night certificates that can easily exceed the annual fee in value:

- Marriott 50K certificate: Usable at hotels costing up to 50,000 points per night

- Hyatt Category 1-4 certificate: Usable at hotels costing up to 15,000 points per night

- IHG anniversary night: Usable at hotels costing up to 40,000 points per night

Maximization tip: Target aspirational properties near the certificate’s upper limit to extract maximum value, and book well in advance as free night inventory can be limited.

Property Credits and Upgrades: The Little Luxuries

Premium cards often include automatic credits or upgrades at specific property collections:

- Amex Fine Hotels & Resorts: $100 property credit, room upgrade, guaranteed late checkout

- Chase Luxury Hotel Collection: Breakfast for two, unique property amenity, potential upgrade

- Visa Infinite Hotels: Room upgrade, complimentary breakfast, late checkout when available

Maximization tip: These programs often have surprisingly competitive base rates, so compare with standard bookings—the included benefits frequently make these the better value even at the same nominal rate.

Travel Protection That Actually Works

Trip Cancellation/Interruption Insurance: The Plan B Provider

This coverage reimburses non-refundable expenses when trips are canceled or cut short due to covered reasons:

- Coverage amounts: Typically $1,500-$20,000 per trip

- Covered reasons: Illness, severe weather, jury duty, and other specified circumstances

- Eligible expenses: Pre-paid, non-refundable travel costs like flights and hotels

Maximization tip: Always pay for at least a portion of your trip with the card providing this coverage, and save documentation of all pre-paid expenses and the reason for cancellation.

Trip Delay Reimbursement: Turning Delays Into Comfort

This benefit covers accommodations and necessities during extended travel delays:

- Activation threshold: Typically 6-12 hours of delay or an overnight stay requirement

- Coverage amounts: Usually $300-$500 per trip

- Eligible expenses: Hotels, meals, transportation, and essentials during the delay

Maximization tip: Contact your card’s benefits administrator during the delay to understand exactly what’s covered, and keep itemized receipts for all expenses you plan to claim.

Baggage Insurance: When Airlines Drop the Ball

This coverage provides reimbursement for lost, damaged, or delayed baggage:

- Delayed baggage: Typically $100-$500 for essentials when bags are delayed 6+ hours

- Lost/damaged baggage: Often $500-$3,000 per passenger for permanently lost items

- Coverage limits: Higher limits for premium cards, with potential per-item caps

Maximization tip: Take photos of your packed luggage before travel as evidence of contents, and obtain an official report from the airline documenting the delay or loss.

Rental Car Protection: The CDW Replacement

Many travel cards offer primary or secondary collision damage waiver coverage:

- Primary coverage: Pays without involving your personal auto insurance (Chase Sapphire, certain Amex cards)

- Secondary coverage: Covers what your personal insurance doesn’t (most other cards)

- Coverage scope: Physical damage and theft of the rental vehicle

- Excluded vehicles: Luxury cars, certain trucks, and exotic vehicles are typically not covered

Maximization tip: Decline the rental agency’s collision coverage when using a card with primary coverage, but you may still need liability insurance as cards don’t cover damage to other vehicles or property.

Statement Credits: The Direct Value Offsets

Annual Travel Credits: The Fee Reducers

Many premium travel cards offer annual statement credits for travel purchases:

- General travel credits: Apply to any travel purchase (like Chase Sapphire Reserve’s $300 credit)

- Airline fee credits: For incidentals like seat selection and baggage (like Amex Platinum’s $200 credit)

- Hotel booking credits: For specific booking channels (like Capital One Venture X’s $300 credit)

Maximization tip: Set calendar reminders to use these credits before they reset, typically annually based on either calendar year or membership year.

Dining and Entertainment Credits: The Lifestyle Enhancers

Some cards include monthly credits for specific merchants or categories:

- Dining credits: Like Amex Gold’s $10 monthly credit at select restaurants

- Entertainment credits: Like Amex Platinum’s streaming credits

- Rideshare credits: Like certain Chase and Amex cards’ Lyft or Uber credits

Maximization tip: Set up automatic small charges for subscription services covered by these credits, ensuring you never leave free money on the table.

Shopping Portal Bonuses: The Hidden Multipliers

Card-specific shopping portals offer bonus points on online purchases:

- Chase Shop Through Chase: 1-15x additional points at hundreds of retailers

- Amex Offers: Targeted statement credits or bonus points for specific merchants

- Capital One Shopping: Price comparison and automatic coupon application

Maximization tip: Install the card issuer’s shopping extension in your browser to automatically alert you when visiting a site with available bonuses.

How to Audit Your Card Benefits

To ensure you’re extracting maximum value from your travel cards, conduct a regular benefits audit:

- Create a benefits inventory: List all the perks each card provides

- Assign value estimates: Calculate what each benefit is realistically worth to you

- Set up tracking: Use a spreadsheet to log benefits used and value received

- Calendar key deadlines: Set reminders for credits that reset or expire

- Annual review: Before paying each card’s annual fee, assess whether you’re receiving sufficient value

Remember: An unclaimed benefit provides zero value. The most valuable card isn’t necessarily the one with the longest benefits list—it’s the one whose benefits align with your actual travel patterns and lifestyle.

Questions Real Travelers Ask About Travel Cards

Answers to the most common travel card questions

The Basics (That People Are Sometimes Afraid to Ask)

“Do travel points actually cover all flight costs, or are there hidden fees?”

When redeeming points or miles for flights, you typically still pay:

- Government taxes and fees: Always your responsibility, ranging from $5.60 for domestic flights to $100-500+ for international flights

- Carrier-imposed surcharges: Vary dramatically by airline program, from zero (United, Southwest) to $500+ (British Airways for transatlantic flights)

- Close-in booking fees: Some airlines charge extra for awards booked within 21 days of departure

The good news: When using transferable points through travel portals (like Chase Travel), these charges are typically included in the point requirement, creating a truly “free” ticket.

Pro tip: Always check the cash amount required along with points before finalizing award bookings. Some programs (particularly British Airways and Virgin Atlantic) charge such high fees that awards may not represent good value.

“How quickly do travel points expire? Will I lose them if I cancel the card?”

The answers vary by program type:

For airline and hotel points:

- Once transferred to the loyalty program, points live in that program and follow that program’s expiration policy

- Most major U.S. programs have eliminated expiration (Delta, United, Southwest, JetBlue)

- Others expire after 18-36 months of inactivity (American, British Airways, Marriott, Hilton)

- Activity that extends expiration includes earning, redeeming, or sometimes just engaging with program partners

For card issuer points (Chase, Amex, etc.):

- Points generally remain valid as long as the account is open and in good standing

- When canceling a card, points are typically:

- Forfeited if it’s your only card in that program

- Preserved if you have another card in the same rewards program

- Transferable to travel partners before closing

- Sometimes transferable to another person’s account

Pro tip: Before canceling any card, develop a point preservation strategy—whether that’s using the points, transferring them to partners, or applying for a no-annual-fee card in the same rewards family.

“How do authorized users work with travel cards? Do they get the same benefits?”

Authorized users typically receive:

- Full earning power: Their spending earns points/miles at the same rate as the primary cardholder

- Partial benefits access: Varies significantly by card, but often includes:

- Airport lounge access (sometimes with guest limitations)

- Rental car insurance when they’re the renter

- Purchase and return protection

Benefits typically not extended to authorized users include:

- Welcome bonuses (they can’t earn their own)

- Annual travel credits (usually limited to primary cardholder)

- Global Entry/TSA PreCheck credits (typically once per account)

- Airline fee credits (usually shared with primary cardholder)

Pro tip: The cost of adding authorized users varies dramatically—from free on many cards to $175+ on premium cards like the Platinum Card. Always compare this cost against the specific benefits extended to determine if it’s worthwhile.

“Can I use travel points for someone else’s travel?”

Yes, but with some limitations:

For airline and hotel programs:

- Most allow you to book awards for anyone, regardless of relationship

- Some require family relationships for certain features (like Korean Air)

- A few allow point transfers to others (often with fees)

For bank travel programs:

- Chase, Amex, and most others allow booking for anyone through their travel portals

- Transfer partners have their own rules about who you can book for

- Some programs allow point transfers only to authorized users or household members

Pro tip: When booking for others, you generally don’t need to be traveling yourself. This makes points especially valuable for family gifts or emergency travel for loved ones.

Strategic Questions for Maximizers

“Is it better to have multiple travel cards or focus on one rewards program?”

The answer depends on your travel patterns and tolerance for complexity:

Multiple card advantages:

- Access to different transfer partners and redemption options

- Ability to maximize various bonus categories

- Diversification against program devaluations

- Broader travel benefits coverage (lounge networks, airline perks, etc.)

Single program advantages:

- Simplicity in earning and managing points

- Faster accumulation toward specific redemption goals

- Easier to track and maximize benefits

- Often lower combined annual fees

For most travelers, the sweet spot is 2-3 complementary cards rather than a wallet full of partially-utilized options. Consider a general travel card plus one co-branded card for your most-used airline or hotel.

Pro tip: Start with one versatile transferable points card like Chase Sapphire Preferred before adding specialized cards. This gives you flexibility while you learn which programs best match your travel patterns.

“How do I choose between using points for economy tickets for multiple trips versus premium cabins once?”

This common dilemma involves both math and personal preference:

The value equation:

- Economy redemptions typically yield 1-1.5 cents per point in value

- Premium cabin redemptions often deliver 3-5+ cents per point

- Purely from a value maximization perspective, premium cabins win

The experience factor:

- Multiple trips may create more total vacation days and memories

- One premium experience might be more memorable and comfortable

- Consider trip length—premium cabins matter more on long-haul flights

The balanced approach many travelers adopt: Use points for economy on shorter flights and domestic trips, but save for premium cabins on special international journeys where the experience difference is most significant.

Pro tip: For trips longer than 8 hours, the comfort upgrade to business class often represents better subjective value than multiple shorter economy redemptions.

“How far in advance should I book award travel for best availability?”

Optimal booking windows vary by destination and cabin class:

For economy awards:

- Domestic flights: 3-6 months out offers good availability and flexibility

- International flights: 6-11 months out for peak seasons, 2-5 months for off-peak

- Last-minute bookings can sometimes yield surprising availability

For premium cabin awards:

- Long-haul business/first: Book when the schedule opens (typically 330-355 days out)

- OR try within 1-2 weeks of departure when unsold seats may be released

- The middle window often has poorest availability

For hotel awards:

- Standard rooms: 3-6 months provides good availability

- Premium rooms and suites: Book as far ahead as allowed (typically 12-13 months)

- Last-minute bookings can yield good availability outside peak seasons

Pro tip: Set up ExpertFlyer alerts for specific flights when your desired awards aren’t immediately available. This automated system will notify you if seats become available due to cancellations or inventory management changes.

“Should I use points for hotels or flights?”

This strategic decision depends on several factors:

Consider using points for flights when:

- Cash prices are extremely high (holiday periods, last-minute bookings)

- Flying premium cabins (business/first class)

- Flexibility in dates or destination isn’t possible

- The destination has reasonably priced accommodation alternatives

Consider using points for hotels when:

- Staying at luxury properties with high cash rates

- Visiting destinations during peak seasons or special events

- Enjoying elite benefits that come with award stays

- Finding particularly good value (fifth night free, point breaks, etc.)

There’s no universal answer, but many travelers find that airline miles typically deliver higher redemption value for premium cabins, while hotel points often provide better value for luxury properties or peak destinations.

Pro tip: Always calculate the cents-per-point value for each potential redemption to help guide your decision, but remember that subjective factors like comfort and convenience matter too.

Practical Travel Card Questions

“What happens if I need to cancel a trip booked with points?”

Cancellation policies vary significantly between programs:

For airline awards:

- Most U.S. carriers have eliminated redeposit fees (United, Delta, American, etc.)

- Some still charge $75-150 for close-in cancellations

- Many international carriers charge $50-200 redeposit fees

- Points typically return to your account immediately or within a few days

For hotel awards:

- Most allow free cancellation until 24-72 hours before check-in

- Some resort properties have more restrictive policies (7-30 days)

- Points generally redeposit immediately upon cancellation

For travel portal bookings:

- Portal-specific policies apply, often mirroring the underlying airline/hotel policy

- Chase and Capital One tend to have more flexible policies than Amex Travel

- Change fees may apply even when the underlying airline wouldn’t charge them

Pro tip: Set calendar reminders a few days before cancellation deadlines to ensure you don’t miss the free cancellation window if your plans might change.

“Do I earn miles/points when redeeming points for travel?”

It depends on how you book:

For airline awards:

- Traditional airline mile redemptions: Generally NO airline miles earned

- Exception: Southwest awards earn points toward Companion Pass qualification

- You typically DO earn credit toward elite status on award flights

For hotel awards:

- Traditional hotel point redemptions: Generally NO hotel points earned

- You typically DO receive elite benefits and night credits toward status

For travel portal bookings:

- Flights booked through Chase/Amex/Capital One portals: Usually YES, you earn airline miles

- Hotels booked through these portals: Usually NO hotel points, and elite benefits may not apply

Pro tip: This distinction makes travel portal bookings particularly valuable for flights but potentially less attractive for hotels if you value elite recognition and benefits.

“Will I still get travel insurance benefits when booking with points?”

This critical question has a nuanced answer:

For travel booked directly with points:

- Many premium cards extend their travel protections to award bookings

- Usually requires paying the taxes/fees with that same card

- Coverage typically matches what you’d get on paid bookings

For partial point payments:

- Cards like Chase Sapphire Reserve extend full coverage even if you pay just part of the trip with the card

- The protection applies to the entire trip, not just the portion paid with the card

Notable exceptions:

- Some cards specifically exclude awards from certain protections

- American Express cards typically require the entire fare (not just taxes) to be charged to the card for coverage

Pro tip: Always review your specific card’s benefits guide before relying on travel protections for award bookings. When in doubt, pay any taxes or additional fees with your premium travel card rather than using points to cover them.

“Are annual fees negotiable? Can I get them reduced or waived?”

While credit card terms are standardized, there is some flexibility:

Retention offers:

- Many issuers provide incentives to keep cards when you call to cancel

- These may include annual fee waivers, statement credits, or bonus points

- Success rates are highest for customers with significant spending history

- Best time to call is shortly after the annual fee posts to your account

Downgrade options:

- Most premium cards have no-annual-fee or lower-fee versions in the same family

- Downgrading preserves your account history and often your existing points

- You’ll lose premium benefits but avoid the higher fee

Military benefits:

- Active duty military may qualify for annual fee waivers under the Servicemembers Civil Relief Act

- American Express and Chase are particularly generous with these waivers

Pro tip: Before calling about your annual fee, review your card usage over the past year and have a specific reason why the fee isn’t currently justified for you. This positions you much better for a retention offer than simply asking for a fee waiver.

The Bottom Line: Getting the Most from Travel Cards in 2025

Travel credit cards can dramatically enhance your travel experiences while reducing costs—but only when selected thoughtfully and utilized strategically. As you navigate the complex landscape of travel rewards in 2025, keep these core principles in mind:

- Match cards to your actual travel patterns, not aspirational ones. The most valuable card is the one whose benefits align with trips you’ll really take.

- View annual fees as investments rather than costs. A premium card delivering $1,000+ in benefits for a $395 fee represents excellent ROI, but only if you use those benefits.

- Start simple before expanding. Begin with one versatile transferable points card before adding specialized options as your expertise grows.

- Develop redemption knowledge. Understanding how to maximize point value through strategic transfers and bookings often matters more than which card you use to accumulate those points.

- Don’t chase every bonus. Focus on building substantial balances in 1-2 flexible currencies rather than small, unusable amounts across many programs.

- Use calendar reminders for benefits. Annual credits, free night certificates, and membership renewals should all have dedicated alerts to ensure you capture their value.

- Reassess your card portfolio annually. Travel patterns change, card benefits evolve, and annual fees increase. Regular portfolio reviews ensure you’re always optimizing for current circumstances.

Remember that travel rewards aren’t just about free trips—they’re about elevating your travel experiences, reducing stress points, and making aspirational journeys accessible. With the right strategy, travel cards can transform how you experience the world without breaking your budget.

Disclaimer: Credit card terms, conditions, and offers change frequently. Information in this guide is accurate as of April 18, 2025. Always verify current offer details directly with card issuers before applying. This content is for informational purposes only and should not be considered financial advice.

AFFILIATE DISCLOSURE: CreditCardWisdom.com may receive compensation when visitors apply through our links and are approved. While we strive to provide comprehensive information about all available cards, our reviews feature cards from our partners. Our editorial integrity is not influenced by compensation arrangements, and we evaluate all cards using consistent standards. See our advertising policy for more details.