Updated: May 2025 | 20 min read

A comprehensive comparison to help you choose the right mobile payment processing solution for your unique business needs.

Hey There, Small Business Owner!

Let’s be real – dealing with payment processing shouldn’t be keeping you up at night. But choosing the right system? That decision can literally put more money in your pocket and save you precious hours every week. Today, we’re diving deep into two popular options: Chase QuickAccept and QuickBooks credit card payments.

Whether you’re ringing up customers at your boutique, sending invoices for your consulting business, or selling artisanal goods at weekend markets, the way you process payments matters a lot. This comprehensive review at Credit Card Wisdom will help you decide which system aligns perfectly with your business needs.

“The best payment processing system isn’t just about the lowest fees—it’s about finding the solution that integrates seamlessly with how you do business every day.”

Let’s cut through the confusion and find exactly what will work for YOUR business.

What We’ll Cover

- Overview: The Basics You Need to Know

- Chase QuickAccept: Features, Pricing & Benefits

- QuickBooks Payments: What Sets It Apart

- Head-to-Head Comparison: The Complete Breakdown

- Which Is Best For Your Type of Business?

- Real User Experiences & Reviews

- The Final Verdict & Recommendations

The Basics: Understanding Mobile Payment Processing

Before we dive into the Chase vs. QuickBooks showdown, let’s get on the same page about what mobile payment processing actually is and why it matters for your small business.

What Is Mobile Payment Processing?

At its core, mobile payment processing allows you to accept credit card payments using smartphones or tablets rather than traditional stationary point-of-sale systems. This can happen through a mobile card reader that connects to your device or through software that lets you manually enter card details.

For small businesses, mobile payment solutions offer extraordinary flexibility—you can take payments at pop-up shops, client locations, markets, or anywhere your business takes you. It’s transformed the way small businesses operate, making “sorry, we only accept cash” a phrase of the past.

Why Your Choice Matters

Choosing between Chase QuickAccept and QuickBooks credit card payments isn’t just about transaction fees (though those are important!). It’s about:

- Integration with your existing systems – Does it work with your banking or accounting software?

- Speed of deposits – How quickly can you access your money?

- Ease of reconciliation – Will it make bookkeeping easier or more complicated?

- Mobility needs – Do you need to take payments on the go or primarily in one location?

- Customer experience – Is the process smooth and professional for your clients?

The right choice can save you hundreds of hours a year in administrative tasks and potentially thousands of dollars in fees. Let’s find your perfect match!

Chase QuickAccept: The Banking Giant’s Mobile Solution

Chase QuickAccept is Chase Bank’s answer to mobile payment processing needs. While it’s designed to work best with Chase Business Complete Banking accounts, it’s important to note that it is a separate service that requires specific enrollment. Let’s look at what makes it stand out.

Key Features

Integrated Mobile App

Process payments directly through the Chase Mobile app

Same-Day Funding

Payments processed by 5 PM PT on business days are deposited that night with Chase QuickAccept

Multiple Payment Options

Accept tap, dip, swipe, or manually entered card payments through Chase’s payment system

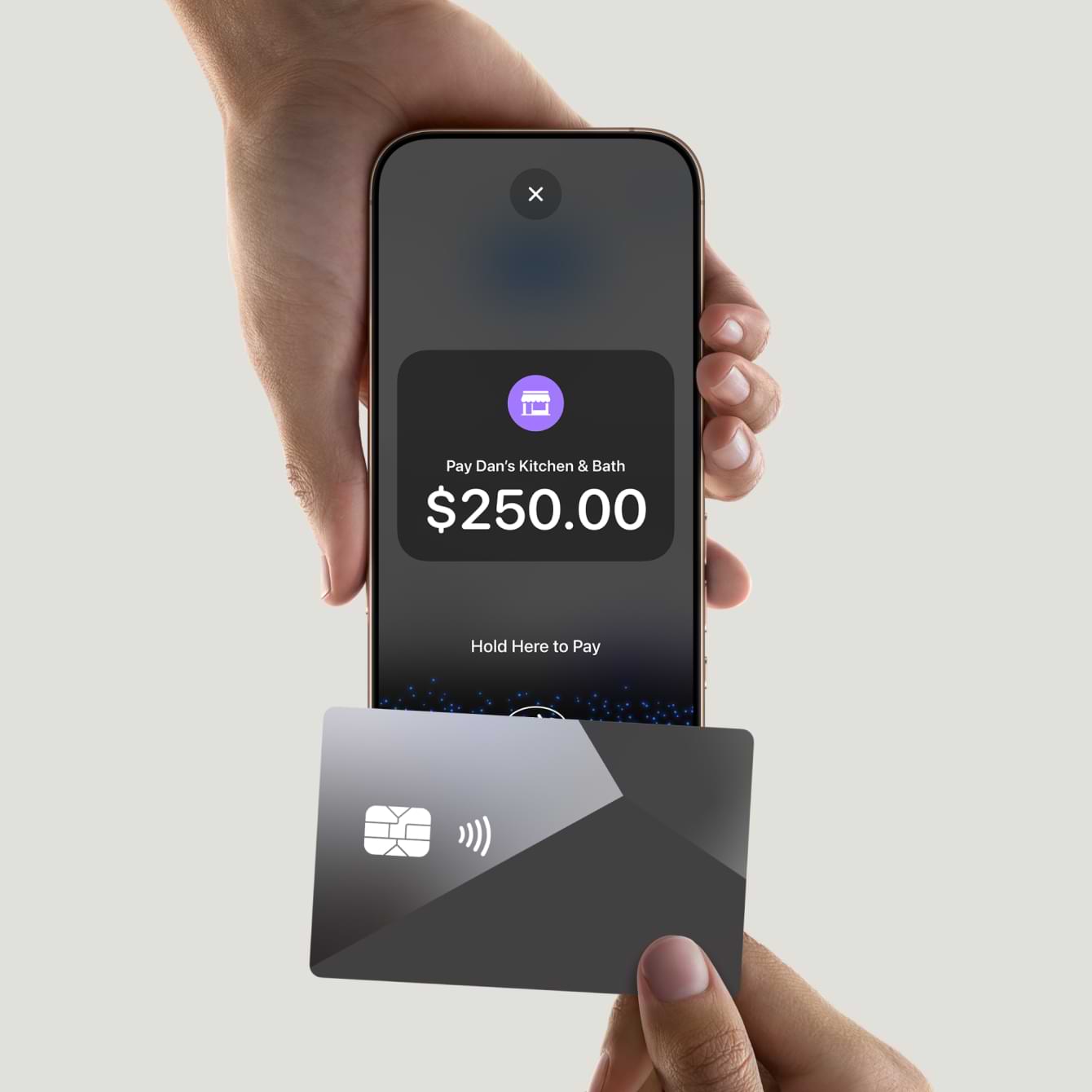

Tap to Pay on iPhone

Use your iPhone as a contactless card reader without additional hardware with Chase Tap to Pay

Additional features include a Bluetooth-enabled card reader, integrated reporting to track sales alongside your banking activity, and business insights that provide access to customer spending patterns and business performance metrics.

Pricing Structure

Chase QuickAccept uses a flat-rate pricing model with straightforward fees:

- Card-present transactions (tap, dip, swipe): 2.6% + $0.10 per transaction

- Card-not-present transactions (keyed): 3.5% + $0.10 per transaction

- No monthly fees or long-term contracts

- Card reader cost: $79 (one-time purchase)

The standout benefit: No additional fees for same-day deposits—a feature many competitors charge extra for!

Integration Benefits

Where Chase QuickAccept really shines is in its integration with the broader Chase ecosystem:

- Direct connection to your Chase Business checking account

- Single sign-on through the Chase Mobile app

- Consolidated view of transactions and banking activity

- Same-day deposits without additional fees

- Works with Chase Point of Sale (POS) systems for larger operations

Who It’s Perfect For

Chase QuickAccept is particularly well-suited for:

- Businesses already banking with Chase

- Merchants who need quick access to their funds

- Mobile businesses that process in-person payments

- Small retailers who want simplified banking and payment processing

- Businesses that value the security and stability of working with a major bank

QuickBooks Payments: The Accountant’s Dream Solution

QuickBooks Payments is Intuit’s integrated payment processing solution designed to work seamlessly with QuickBooks accounting software. It takes a different approach, focusing on accounting integration rather than banking.

Key Features

Automatic Bookkeeping

Payments are automatically recorded in your QuickBooks accounting system

Multiple Payment Channels

Accept payments via invoices, mobile card reader, or manual entry

GoPayment Mobile App

Dedicated app for processing on-the-go payments

Recurring Billing

Set up automatic payment plans for regular clients with QuickBooks Payments

Additional features include Tap to Pay on iPhone capabilities, card reader options, multiple payment methods (credit/debit cards, ACH bank transfers, digital wallets), and customer management for storing payment information.

Pricing Structure

QuickBooks Payments also uses a flat-rate pricing model:

- Card-present transactions: 2.5% per transaction

- Online invoices: 2.99% per transaction

- Keyed/manual transactions: 3.3% + $0.30 per transaction

- ACH bank transfers: 1% (max $15) per transaction

- No monthly fees with QuickBooks Online subscription

- Card reader cost: Varies by model, typically $49-$79

The standout benefit: Automatic synchronization with your QuickBooks accounting—no manual data entry required!

Integration Benefits

QuickBooks Payments’ strongest advantage is its tight integration with QuickBooks accounting software:

- Automatic recording of payments in your books

- Payments automatically matched to invoices

- Real-time updating of customer balances

- Simplified reconciliation of transactions

- Detailed reporting on payment status and history

- Works across QuickBooks Online, Desktop, and Self-Employed versions

Who It’s Perfect For

QuickBooks Payments is ideal for:

- Businesses already using QuickBooks for accounting

- Service-based businesses that send a lot of invoices

- Companies that value automated bookkeeping

- Businesses with recurring billing needs

- Organizations that need to accept various payment methods, including ACH

Head-to-Head Comparison: The Complete Breakdown

Now that we’ve looked at each solution individually, let’s compare Chase QuickAccept and QuickBooks Payments directly across key factors that matter most to small businesses.

| Feature | Chase QuickAccept | QuickBooks Payments |

|---|---|---|

| In-person transaction fee | 2.6% + $0.10 | 2.5% |

| Keyed transaction fee | 3.5% + $0.10 | 3.3% + $0.30 |

| Online invoice fee | 3.5% + $0.10 | 2.99% |

| ACH payments | Not offered directly | 1% (max $15) |

| Deposit timing | Same-day deposits with eligible Chase business accounts | 1-3 business days (faster deposits available for additional fee) |

| Hardware requirements | Optional card reader ($79) or Tap to Pay on iPhone | Optional card reader ($49-$79) or Tap to Pay on iPhone |

| Banking integration | Excellent (Chase banking) | Limited (works with most banks but no direct integration) |

| Accounting integration | Limited (requires manual export to accounting software) | Excellent (QuickBooks) |

| Mobile experience | Integrated with Chase Mobile app | Dedicated GoPayment app |

| Payment types accepted | Credit/debit cards, digital wallets | Credit/debit cards, ACH, digital wallets, PayPal, Venmo |

Ease of Use Comparison

Chase QuickAccept

- One app for banking and payments (streamlined)

- Simple interface focused on fast transactions

- Minimal setup if you already have a Chase account

- Less accounting functionality

- Great for quick, in-person sales

QuickBooks Payments

- Separate app for mobile payments (more to manage)

- More feature-rich interface (steeper learning curve)

- More setup required initially

- Extensive accounting features

- Great for service-based and invoice-heavy businesses

Pros & Cons Summary

Chase QuickAccept Pros

- Same-day deposits at no extra cost

- Integrated with Chase banking

- Simple, streamlined mobile experience

- No monthly fees

- 24/7 customer support from Chase

Chase QuickAccept Cons

- Requires Chase Business checking account

- Limited accounting integration

- Slightly higher fees for in-person transactions

- No ACH payment option

- Fewer payment types accepted

QuickBooks Payments Pros

- Seamless QuickBooks accounting integration

- More payment methods (including ACH)

- Better rates for online invoices

- Robust reporting features

- Works with non-Chase banks

QuickBooks Payments Cons

- Slower standard deposit times

- Extra fee for instant deposits

- Requires QuickBooks Online for full benefits

- Separate app for mobile payments

- More complex setup process

Which Is Best For Your Type of Business?

The right choice between Chase QuickAccept and QuickBooks Payments largely depends on your specific business model and priorities. Let’s break it down by business type:

Choose Chase QuickAccept If You’re:

Retail Store Owner

You need quick access to your funds to manage inventory and cash flow, and you value the simplicity of having payments and banking in one place. Learn more about Chase QuickAccept for retail.

Market Vendor or Pop-up Shop

You process a high volume of in-person transactions and need your money available quickly to restock and manage expenses. See Chase’s in-person payment solutions.

Food Truck or Mobile Business

You’re constantly on the move and need a simple, reliable way to take payments through your phone with minimal equipment. Check out Chase Tap to Pay on iPhone.

Chase Business Banking Customer

You already have a Chase business account and want the convenience of integrated banking and payment processing. Explore QuickAccept integration.

Choose QuickBooks Payments If You’re:

Service-Based Business

You regularly send invoices to clients and need automated bookkeeping to track payments against those invoices. Learn about QuickBooks invoicing.

QuickBooks User

You already use QuickBooks for accounting and want your payment processing to integrate seamlessly with your existing system. See how QuickBooks Payments integrates.

Subscription-Based Business

You need to set up recurring payments and manage customer payment information securely. Explore QuickBooks recurring billing.

B2B Company

You work with other businesses that prefer to pay via ACH transfer rather than credit card, making QuickBooks’ ACH option valuable. Learn about ACH payments with QuickBooks.

Hybrid Business Solution

Some businesses might benefit from using both systems simultaneously for different purposes:

- Use Chase QuickAccept for in-person sales when you need quick access to funds

- Use QuickBooks Payments for invoicing and recurring payments to maintain clean books

While this creates additional complexity, it allows you to leverage the strengths of each platform where they matter most.

Real User Experiences & Reviews

When making your decision, it’s valuable to consider the experiences of other small business owners who’ve used these services. Here’s what they’re saying:

Chase QuickAccept User Feedback

“The same-day funding has been a game-changer for my seasonal business. I can restock inventory the same day after a big sales event.”– Retail store owner in Chicago

“I appreciate having everything in one app—I can check my bank balance and process a payment without switching between programs.”– Mobile service provider

“The setup was incredibly easy since I already had a Chase business account. However, I do wish it integrated better with my accounting software.”– Small manufacturer

Common Praise Points:

- Fast access to funds

- Reliable processing

- Intuitive mobile app

- Good customer support

Common Criticisms:

- Limited accounting integration

- Occasional app glitches

- Processing delays for larger transactions

QuickBooks Payments User Feedback

“The automatic reconciliation is worth every penny. I used to spend hours matching payments to invoices—now it happens instantly.”– Consultant in Seattle

“Being able to offer ACH as a payment option has reduced my processing fees significantly since many of my B2B clients prefer it over credit cards.”– Marketing agency owner

“The reporting is fantastic, but I do wish the funds were available faster. Sometimes I have to wait 2-3 days to access my money.”– Online retailer

Common Praise Points:

- Seamless accounting integration

- Multiple payment options

- Detailed reporting

- Reliable invoicing system

Common Criticisms:

- Slower standard deposit times

- Occasional sync issues

- Steeper learning curve

“Remember that every business is unique. The features that matter most to others might not be your top priorities. Focus on how each system aligns with YOUR specific workflow and financial needs.”

The Final Verdict: Making Your Choice

After thoroughly comparing Chase QuickAccept vs QuickBooks credit card payments, it’s clear that both offer strong mobile payment processing options but with different strengths that suit different business needs.

My Recommendations

Choose Chase QuickAccept if:

- You already bank with Chase and want integrated banking/payment processing

- Same-day access to your funds is critical to your business operations

- You primarily process in-person transactions

- You value simplicity and ease of use over robust accounting features

- You’re comfortable with manual accounting or using a separate accounting system

Choose QuickBooks Payments if:

- You already use QuickBooks for accounting

- Automated bookkeeping and transaction categorization are high priorities

- You need to offer multiple payment methods, including ACH

- You frequently send invoices or have recurring billing needs

- You can wait 1-3 days for funds to be deposited (or are willing to pay extra for faster access)

Ready to Take the Next Step?

Whichever system you choose, setting up credit card processing will help your business grow by providing more payment options to your customers.

Learn more about Chase QuickAccept here or QuickBooks Payments here.

Final Thoughts

The “best” mobile payment processing solution isn’t universal—it depends entirely on your business model, existing systems, and financial priorities. Take the time to evaluate both options against your specific needs.

Remember that payment processing is just one piece of your business’s financial ecosystem. The right choice should complement your banking, accounting, and operational workflows rather than complicating them.

By choosing the system that aligns with your current needs while allowing room for growth, you’ll be setting yourself up for success and ensuring that payment processing supports—rather than hinders—your business goals.

Frequently Asked Questions

Can I use Chase QuickAccept if I don’t have a Chase business account?

No, Chase QuickAccept is exclusively available to businesses with a Chase Business Complete Banking account. You’ll need to open an account to access this payment processing solution.

Does QuickBooks Payments work with QuickBooks Desktop?

Yes, QuickBooks Payments is compatible with both QuickBooks Online and Desktop versions, though some features may vary between versions.

Which solution has lower overall fees?

It depends on your transaction mix. For in-person transactions, QuickBooks Payments is slightly less expensive (2.5% vs. 2.6% + $0.10). For online invoices, QuickBooks is also less expensive (2.99% vs. 3.5% + $0.10). However, Chase offers free same-day deposits which can offset these differences for businesses that value quick access to funds.

Can I use both systems at the same time?

Yes, some businesses use Chase QuickAccept for in-person transactions (taking advantage of same-day funding) while using QuickBooks Payments for invoices and recurring payments (leveraging the accounting integration). This requires managing two systems but allows you to optimize for different payment scenarios.

Are there any long-term contracts or cancellation fees?

Neither Chase QuickAccept nor QuickBooks Payments requires long-term contracts, and neither charges early termination fees. Both operate on a pay-as-you-go model, though QuickBooks Payments requires an active QuickBooks subscription for full functionality.

How do I handle chargebacks and disputes?

Both systems have processes for handling chargebacks, but QuickBooks offers more robust dispute protection (up to $25,000 per year, $10,000 per dispute on card payments). Chase’s fraud protection services help prevent unauthorized transactions but have different dispute resolution processes.

Disclosure: The information provided in this review is based on current rates and features as of May 2025. Pricing and features may change, so always verify the most current information on the official websites before making a decision. This review is based on extensive research and user feedback but should not be considered financial advice.

This review is brought to you by Credit Card Wisdom, where we help small business owners make informed decisions about credit card reviews and payment processing solutions.