Car Rental Credit Card Coverage & Benefits: The Complete Guide

Everything you need to know about using your credit card for rental car insurance, coverage details, and maximizing your travel benefits—explained in a friendly, approachable way.

Why Rental Car Insurance Coverage with Credit Cards Matters

If you’ve ever felt a tad overwhelmed at the car rental counter, you’re not alone! Being offered insurance options you don’t fully understand can be stressful—especially when you want to make smart financial choices. The good news is, your credit card might quietly hold the secret to substantial savings and peace of mind on your next rental.

This guide digs deep into how credit card rental car coverage works, how to tell if your card offers it, how best to use it, and which cards provide the best protection (with plenty of practical tips for travelers at all stages).

Understanding Rental Car Insurance from Your Credit Card

So, what does it actually mean when your credit card says it “covers rental cars”? Most leading credit cards—especially those in the travel or premium rewards categories—offer some level of protection for rental vehicles. This coverage usually applies to the rental car’s physical damages (think: accident, theft, or vandalism) and kicks in when you pay with the card and decline the rental agency’s policy at the counter.

What’s covered?

- Damage to the rental car in an accident

- Theft of the rental car

- Vandalism, fire, or weather damage

- Loss-of-use fees (income lost to the agency while the car is repaired)

- Towing charges for covered losses

What’s not covered?

- Liability coverage for injuries or property damage to others

- Medical/ambulance bills (for you or others in the car)

- Damage to items inside the car (like backpacks, laptops)

- Exotic or certain vehicle types (luxury, RVs, motorcycles, trucks, large vans)

- Illegal, intoxicated, or reckless driving

Always be sure to read your card’s “Guide to Benefits” or call customer service for details, as coverage, country exclusions, and limitations can vary widely among issuers.

Primary vs. Secondary Rental Car Insurance—What’s the Difference?

One of the trickiest distinctions: primary versus secondary coverage.

| Coverage Type | How It Works | Typical Cards |

|---|---|---|

| Primary | Covers rental car damage/theft BEFORE your personal auto insurance. No claim with your insurer. | Chase Sapphire Reserve, Chase Sapphire Preferred, Capital One Venture X |

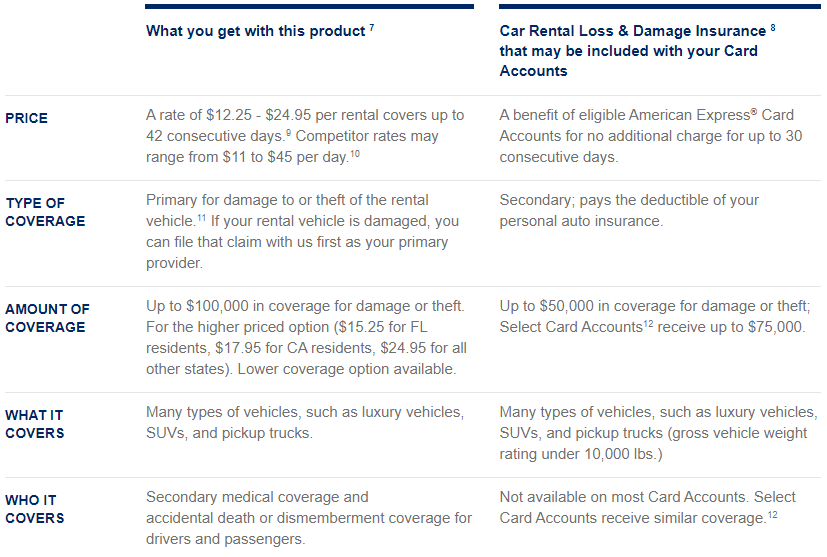

| Secondary | Covers what your primary insurance doesn’t (typically the deductible). If you have no auto insurance, sometimes acts as primary. | Amex Platinum (unless upgrade purchased), most other major issuers |

Why does this matter? Filing a claim with your own insurance can lead to higher premiums—or at least a time-consuming paperwork headache. With primary coverage, your insurer often isn’t involved at all!

Primary coverage means less hassle and potentially no premium increase if a mishap happens.

How to Use Your Credit Card’s Rental Car Insurance: Step-by-Step

- Check your card’s Guide to Benefits.

Call the issuer or review their site for specifics on rental coverage. Know the coverage limit and vehicle types.

- Book your rental car and pay in full with the card offering coverage.

- At the counter, decline the rental car agency’s collision/loss damage waiver (CDW/LDW).

- Make sure the driver(s) are all listed on the rental agreement.

- If an incident occurs: Get all relevant paperwork (accident report, police report if required, repair bills, photos), then call your card’s benefits administrator to begin the claim.

Always keep copies of your rental agreement and your card statement showing payment, just in case you need to file a claim later!

The Best Credit Cards for Rental Car Insurance (& Perks!)

Not all cards are created equal. Here’s a rundown of 2024’s top picks for drivers seeking robust protection and perks:

| Card | Rental Coverage | Perks & Features | Annual Fee | Apply |

|---|---|---|---|---|

| Chase Sapphire Reserve | Primary (up to $75,000 USD) | Travel credits, airport lounge access, elite status with certain car rental agencies | $550 | Learn More |

| Chase Sapphire Preferred | Primary | Great travel rewards, personal trip coverage | $95 | Learn More |

| Capital One Venture X | Primary | Travel insurance, airport lounges, Hertz elite status | $395 | Learn More |

| American Express Platinum | Secondary (primary available for a fee) | Premium travel, lounge access, car rental elite status | $695 | Learn More |

| Bilt World Elite Mastercard | Primary (up to $50,000) | Earn points on rent, travel rewards | $0 | Learn More |

Terms apply. Always check the Guide to Benefits at the time of application or account opening.

Elite Car Rental Status: Unlock Upgrades & Extras with Your Card

Did you know premium credit cards can also elevate your rental experience? Many top-tier cards grant you automatic elite status with major car rental companies, bringing benefits like upgrades, discounts, and skip-the-line privileges.

- Amex Platinum: Pres. Circle Hertz, Avis Preferred, and National Emerald Club Executive—free upgrades and priority service.

- Capital One Venture X: Hertz President’s Circle elite status.

- Chase Sapphire Reserve: Visa Infinite perks—status with Avis, National, Hertz, and Silvercar; exclusive discounts.

Common Pitfalls and Pro Tips

- Don’t assume you’re covered everywhere: Some cards exclude certain countries (e.g., Italy, Australia, New Zealand), as well as luxury/exotic vehicles.

- Decline the agency’s insurance: If you don’t, your card’s protection may be void.

- Keep all receipts and paperwork: Essential for claims.

- Enrolling in enhanced coverage (Amex): If you rent often, Amex’s Premium Car Rental Protection can be a good (fee-based) shortcut to primary coverage.

In doubts or for business rentals, always verify with your card issuer; terms change periodically and benefits can be specific to personal or business usage.

FAQs: Quick Answers to Your Top Rental Car Coverage Questions

How do I know if my card has rental car coverage?

Check the “Guide to Benefits” sent with your card, look online, or call customer service for up-to-date details.

Does rental car credit card insurance cover liability?

No—almost never. It only covers the vehicle. For liability, ensure your auto policy extends coverage (or buy it at the counter).

Can I get covered if I don’t own a car?

Yes—your card’s coverage usually acts as primary when you have no auto insurance.

What steps should I take in case of damage?

Document everything (photos, police/rental report, repair estimates), and call your card’s benefits line as soon as possible.