Introduction: Stepping Into the Credit World

Look, I get it. The world of credit can feel like walking into a party where everyone seems to know the rules except you. Whether you’re just starting your adult life, rebuilding after financial setbacks, or simply trying to navigate the sometimes-confusing world of plastic, you’re not alone.

Here’s the thing—credit isn’t just about buying things you can’t afford (though let’s be honest, we’ve all been tempted). It’s actually a powerful tool that, when used wisely, opens doors to future opportunities: better apartment rentals, lower insurance rates, and even your dream home someday.

This guide isn’t just another sterile list of do’s and don’ts. It’s your road map through the credit landscape, filled with real advice that works in the real world. We’ll explore everything from picking your first card to rebuilding damaged credit, all while keeping things practical and, dare I say, occasionally entertaining.

Ready to transform your financial future? Let’s dive in.

Understanding Credit: The Basics You Need to Know

What Is Credit, Really?

At its heart, credit is simply borrowed money with a promise to pay it back. But it’s also so much more—it’s a reflection of your financial trustworthiness.

Think of credit as your financial reputation. When you borrow money and repay it as agreed, you build a positive history that tells future lenders, “Hey, this person follows through on their commitments.” This reputation is summarized in your credit score and detailed in your credit report.

The Credit Score Breakdown: What Makes Up That Magic Number

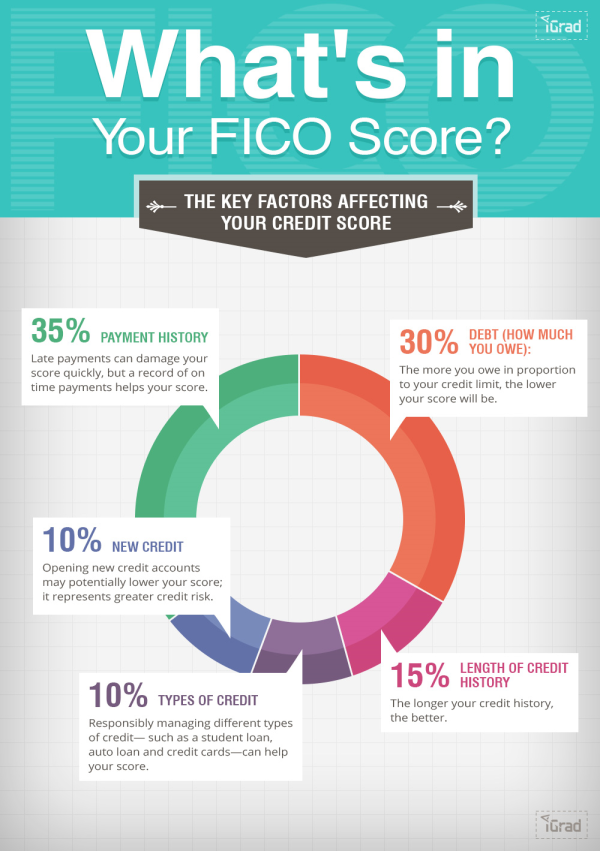

Your credit score—that three-digit number between 300 and 850—might seem mysterious, but it’s actually calculated based on specific factors. Understanding these components helps you know exactly where to focus your efforts.

According to FICO, the most widely used credit scoring model, your score consists of:

- Payment History (35%): Do you pay your bills on time? This is the heavyweight champion of credit factors. Even one missed payment can significantly impact your score.

- Amounts Owed (30%): How much of your available credit are you using? (This is your credit utilization ratio—more on that in a bit).

- Length of Credit History (15%): How long have you been using credit? Longer histories give lenders more data to evaluate your habits.

- Credit Mix (10%): What types of credit do you use? Having different types (credit cards, loans, etc.) can positively impact your score.

- New Credit (10%): How frequently are you applying for new credit? Too many applications in a short period might make lenders nervous.

Wait—why does all this matter? Because understanding these factors gives you the power to strategically improve your score. It’s like knowing exactly which exercises will help you lose weight versus just working out randomly. Source

Credit Reports: Your Financial Biography

Your credit report is essentially your financial biography, telling the story of how you’ve handled credit throughout your life. It includes:

- Account information (open and closed)

- Payment history

- Credit inquiries

- Public records (like bankruptcies)

- Personal information (name, address, etc.)

By law, you’re entitled to one free credit report annually from each of the three major bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. I’d recommend staggering these throughout the year—check one bureau every four months to keep a regular eye on your credit health.

Honestly, checking your reports regularly isn’t just about tracking improvement—it’s also about catching errors or fraud early. About 1 in 5 Americans has an error on their credit report that could affect their score. Don’t let a mistake cost you a lower interest rate or loan approval. Source

First-Time Credit Cards: Where to Begin

Are You Ready for Your First Credit Card?

Before you start applying for cards, ask yourself:

- Do you have a steady income source?

- Can you keep track of spending and pay bills on time?

- Do you understand the responsibility of borrowing money?

If you answered “yes” to these questions, you’re likely ready to start your credit journey. If not, that’s okay too—maybe focus on building good financial habits first, like creating a budget and establishing an emergency fund.

Types of Cards for Beginners

Not all credit cards are created equal, especially for beginners. Here are the main types to consider:

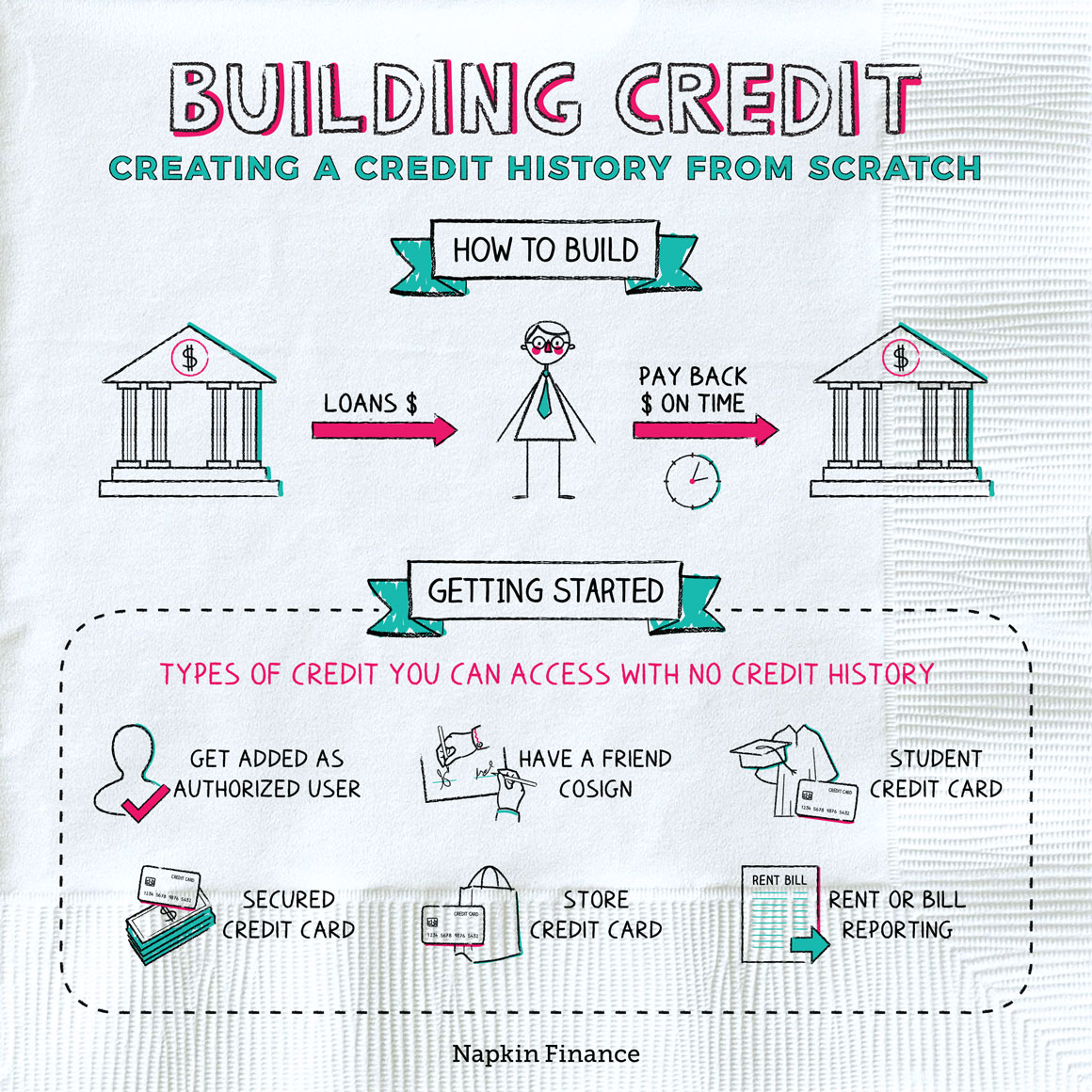

Secured Credit Cards: Training Wheels for Credit Beginners

:max_bytes(150000):strip_icc()/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215-f0faefaa72694b7e9ce3e5efd853a502.png)

Secured cards require a security deposit that typically equals your credit limit. Think of this deposit as a safety net for the issuer—if you don’t pay, they can keep your deposit. While this might sound restrictive, secured cards are often the most accessible option for those with no credit history or past credit problems.

The beauty of secured cards is that they report to the credit bureaus just like regular cards. Use one responsibly for 6-12 months, and you’ll likely qualify for an unsecured card. At that point, your security deposit is refunded.

Some top secured cards for 2025 include:

- Discover it® Secured Credit Card: Rare among secured cards, it offers cash back rewards and has no annual fee

- Capital One Platinum Secured Credit Card: Potential for a credit limit higher than your security deposit

- Citi® Secured Mastercard®: No annual fee and reports to all three major credit bureaus

Student Credit Cards: Designed for College Life

If you’re a college student, student credit cards offer an excellent entry point. These cards typically have:

- Lower credit score requirements

- Student-specific perks (like good-grade rewards)

- No or low annual fees

- Educational resources

Some solid student card options include:

- Discover it® Student Cash Back: Rotating 5% cash back categories

- Bank of America® Customized Cash Rewards for Students: 3% cash back in a category of your choice

- Capital One SavorOne Student Cash Rewards Credit Card: 3% back on dining, entertainment, and grocery stores

Retail Store Cards: Easy to Get, Limited Use

Store credit cards can be easier to qualify for than traditional cards but often come with high interest rates and can only be used at specific retailers. They can be a stepping stone, but be careful—their limited utility and high APRs make them less ideal than other options. Source

The Application Process: What to Expect

Applying for your first credit card isn’t complicated, but knowing what to expect helps prevent surprises:

- Research cards that match your profile: Look for cards marketed to beginners or students if that applies to you.

- Check for pre-qualification: Many issuers let you check if you’re pre-qualified without affecting your credit score.

- Gather necessary information: You’ll need your Social Security number, income information, and address history.

- Complete the application: This can usually be done online in about 10-15 minutes.

- Wait for a decision: You might get approved instantly, or it could take up to two weeks.

If you’re denied, don’t panic—and definitely don’t immediately apply for another card. Instead:

- Request the reason for denial (lenders must provide this)

- Address those specific issues

- Consider a secured card if you weren’t already applying for one

- Wait at least 3-6 months before trying again

Building Credit Responsibly: The Foundation of Financial Success

The Golden Rules of Credit Building

Building credit isn’t about complex strategies—it’s about consistently following a few fundamental principles:

Pay on Time, Every Time

Nothing—and I mean nothing—impacts your credit score more than your payment history. One 30-day late payment can drop a good score by 80+ points and stay on your report for seven years. Ouch.

Set up auto-pay for at least the minimum payment (though paying in full is better), use calendar reminders, or whatever system works for you. Just make sure those payments are never late.

Keep Your Credit Utilization Low

Your credit utilization ratio—the percentage of your available credit that you’re using—is the second-most important factor in your score. Aim to keep this below 30%, but for the best scores, stay under 10%.

For example, if you have a $1,000 credit limit, try not to carry a balance above $300, and ideally keep it under $100.

“But wait,” you might be thinking, “doesn’t carrying a balance help build credit?” That’s actually one of the biggest credit myths out there. You don’t need to carry a balance to build credit—just use your card and pay it off in full each month. Your credit-building activity is reported regardless of whether you pay interest. Source

Start Small and Be Patient

Credit building is a marathon, not a sprint. Start with one card, master responsible usage, and give yourself time to build history before adding more accounts.

As the saying goes, “The best time to plant a tree was 20 years ago. The second best time is now.” Even if you’re starting late, consistent good habits will gradually improve your score.

Beyond the Basics: Advanced Credit-Building Strategies

Once you’ve mastered the fundamentals, consider these strategies to accelerate your credit-building journey:

Become an Authorized User

If someone you trust (like a parent or spouse) has good credit, ask if they’ll add you as an authorized user on their card. Their positive history with that card can help boost your score, even if you never use the card yourself.

Just be aware that this works both ways—if the primary cardholder misses payments or maxes out the card, it could hurt your credit too. Make sure you trust them completely and that they have excellent credit habits.

Diversify with a Credit-Builder Loan

Credit-builder loans are specifically designed to help people establish credit history. Unlike typical loans, you don’t receive the money upfront. Instead:

- You apply for the loan (usually $300-$1,000)

- The “loan” amount is held in a savings account

- You make monthly payments

- After the loan term (typically 6-24 months), you receive the money plus any interest earned (minus fees)

These loans help establish payment history and add installment credit to your mix, which can boost your score in multiple ways. Credit unions and online lenders like Self and Credit Strong offer these products.

Keep Old Accounts Open

The length of your credit history accounts for 15% of your FICO score. Even if you no longer use an old credit card, keeping it open (especially if it has no annual fee) helps lengthen your average account age.

If you must close accounts, start with newer ones and keep your oldest accounts active by using them occasionally for small purchases. Source

Common Credit Mistakes and How to Avoid Them

Rookie Errors That Can Set You Back

Even the most financially savvy people make mistakes sometimes. Here are some common pitfalls and how to avoid them:

Missing Payments (Even by Accident)

This bears repeating because it’s that important: missed payments are credit score killers. Even one missed payment can significantly impact your score.

Solution: Set up automatic payments for at least the minimum amount due. You can always pay more manually, but automation ensures you never miss a payment deadline.

Applying for Multiple Cards at Once

Each credit application typically results in a hard inquiry on your credit report, which can lower your score by a few points. Multiple applications in a short period can signal financial distress to lenders.

Solution: Space out credit applications by at least 3-6 months, and only apply for cards you have a good chance of being approved for.

Maxing Out Your Cards

Using all or most of your available credit signals potential financial trouble to lenders, even if you pay in full each month.

Solution: Try to keep your balance below 30% of your credit limit at all times. If you need to make a large purchase, consider paying down your balance before your statement closing date or making multiple payments throughout the month. Source

Credit Myths Debunked

The credit world is full of misconceptions that can lead you astray. Let’s clear up some common myths:

Myth 1: Checking Your Own Credit Hurts Your Score

Reality: Checking your own credit creates a “soft inquiry” that doesn’t affect your score at all. Only “hard inquiries” from lenders when you apply for credit can impact your score.

Myth 2: You Need to Carry a Balance to Build Credit

Reality: Your payment activity is reported to credit bureaus whether you carry a balance or not. Paying in full each month builds credit without costing you interest.

Myth 3: Closing Credit Cards Improves Your Score

Reality: Closing credit cards can actually hurt your score by reducing your available credit (which increases your utilization ratio) and eventually shortening your credit history when the closed accounts fall off your report.

Myth 4: Co-signing Doesn’t Affect Your Credit

Reality: When you co-sign, you’re equally responsible for the debt. If the primary borrower misses payments, your credit will suffer just as much as theirs.

Myth 5: All Credit Scores Are the Same

Reality: There are dozens of different credit scoring models. While FICO scores are most widely used by lenders, even FICO has multiple versions. This is why your score might vary depending on where you check it. Source

Rebuilding Credit: The Road to Recovery

Everyone Deserves a Second Chance

Financial setbacks happen—medical bills, job loss, or simply past mistakes can damage your credit. The good news? Credit scores can recover, and often faster than you might think.

Understanding What Went Wrong

Before rebuilding, take an honest look at what caused your credit issues. Was it:

- Overspending and high balances?

- Missed payments due to disorganization?

- Identity theft or errors on your report?

- Major life events like job loss or illness?

Identifying the root causes helps ensure you don’t repeat the same patterns.

Your Step-by-Step Rebuilding Plan

Rebuilding credit takes time, but with a systematic approach, you can make steady progress:

1. Check Your Credit Reports for Errors

About 20% of credit reports contain errors. Request your free reports from AnnualCreditReport.com and dispute any inaccuracies you find.

2. Get Current on All Accounts

If you have past-due accounts, bring them current as soon as possible. Consider contacting creditors to negotiate payment plans if needed.

3. Consider a Secured Credit Card

As mentioned earlier, secured cards are excellent rebuilding tools. After 6-12 months of responsible use, many secured cards can be upgraded to unsecured options.

4. Keep Balances Low

Pay down existing debt and keep your credit utilization below 30% on all cards.

5. Be Strategic About New Credit

Apply selectively and only when necessary. Each application creates a hard inquiry that temporarily lowers your score.

6. Be Patient and Consistent

Most negative items (except bankruptcies) stay on your credit report for seven years. However, their impact diminishes over time, especially as you build positive history.

The truth is, rebuilding credit is less about quick fixes and more about consistent good habits over time. It might take 1-2 years to see significant improvement, but many people see their scores begin to rise within a few months of implementing these strategies. Source

Advanced Credit Card Management: Maximizing Benefits

From Credit Builder to Credit Master

Once you’ve established good credit habits and improved your score, you can begin to leverage credit cards for their benefits rather than just credit building.

Understanding Rewards Programs

Credit card rewards generally fall into three categories:

Cash Back

The simplest reward type—you earn a percentage of your purchases back as cash, statement credits, or deposits to your bank account.

- Flat-rate cards: Offer the same percentage on all purchases (typically 1.5-2%)

- Tiered cards: Offer higher percentages in specific categories (like 3% on dining, 2% on groceries)

- Rotating category cards: Offer high percentages (often 5%) in categories that change quarterly

Travel Rewards

Travel cards earn points or miles that can be redeemed for flights, hotels, car rentals, and other travel expenses.

- Co-branded cards: Affiliated with specific airlines or hotel chains

- General travel cards: Offer flexible points that can be used across multiple travel partners

Points Programs

Some cards earn points that can be redeemed for various rewards, including merchandise, gift cards, travel, and sometimes cash back.

Responsible Rewards Maximization

Rewards cards offer great benefits but can lead to overspending if you’re not careful. Follow these guidelines:

- Never spend more just to earn rewards

- Pay in full to avoid interest (which will always exceed the value of rewards)

- Choose cards that match your spending patterns

- Be strategic about sign-up bonuses (but don’t apply for too many cards at once)

When to Upgrade Your Card Portfolio

As your credit improves, you may qualify for cards with better benefits and lower interest rates. Consider upgrading when:

- Your score has improved significantly (typically above 700)

- You’ve had your current card for at least a year

- You’re consistently spending in categories where better rewards are available

- The upgraded card’s benefits outweigh any annual fee

Many issuers allow product changes (switching from one card to another) without a new application or credit check, which can be a great way to upgrade without impacting your credit.

The Long Game: Maintaining and Improving Your Credit

Credit as a Lifelong Tool

Credit management isn’t something you master once and forget about—it’s an ongoing financial practice that evolves as your life does.

Regular Credit Monitoring

Make checking your credit a habit, like brushing your teeth or getting an annual physical:

- Review your credit reports at least annually

- Check your credit score monthly (many credit cards and banks now offer free scores)

- Set up fraud alerts to be notified of suspicious activity

Adapting to Life Changes

Your credit needs will change as your life does:

- Marriage: Decide whether to maintain separate accounts or merge finances

- Homebuying: Prepare your credit 6-12 months before applying for a mortgage

- Growing family: Consider how additional expenses impact your credit usage

- Retirement planning: Maintain good credit even as you approach retirement (it affects insurance rates and rental applications)

When to Seek Professional Help

Sometimes, DIY credit management isn’t enough. Consider professional help if:

- You’re overwhelmed by debt

- You’ve been a victim of identity theft

- You have complex credit issues affecting major life goals

Options include:

- Credit counseling from nonprofit agencies

- Financial advisors for comprehensive planning

- Consumer law attorneys for serious credit report errors or identity theft

Just be cautious of “credit repair” companies promising quick fixes—if it sounds too good to be true, it probably is.

Conclusion: Your Credit Journey Starts Now

Building credit is a journey, not a destination. Whether you’re just starting out, rebuilding after setbacks, or looking to optimize your credit usage, remember that consistency is key.

The credit system might seem complex at first glance, but it ultimately rewards responsible behavior over time. By understanding the fundamentals, avoiding common pitfalls, and following the strategies outlined in this guide, you’re well on your way to building a strong credit profile that will serve you throughout your financial life.

Remember—every financial decision you make today shapes your options tomorrow. With patience and persistence, good credit is within your reach.

Ready to take the next step? Choose one action from this guide to implement this week, whether it’s checking your credit report, researching your first card, or setting up automatic payments. Small steps today lead to significant progress over time.

Your future self will thank you.

FAQ: Quick Answers to Common Credit Questions

Q: How long does it take to build credit from scratch?

A: With consistent responsible use, you can establish a credit score in about 6 months and build a good score within 1-2 years.

Q: Will checking my credit score lower it?

A: No. Checking your own score creates a “soft inquiry” that doesn’t affect your score.

Q: Do I need to carry a balance to build credit?

A: Absolutely not. Paying your balance in full each month builds credit just as effectively without costing you interest.

Q: How many credit cards should I have?

A: There’s no universal answer, but most experts suggest 2-3 cards once you’ve established good habits. Start with just one until you’re comfortable managing it responsibly.

Q: What’s a good credit utilization ratio?

A: Aim to keep your utilization below 30%, but for the best scores, stay under 10%.

Q: How long do negative items stay on my credit report?

A: Most negative items stay for 7 years, while bankruptcies can remain for up to 10 years. However, their impact diminishes over time, especially as you add positive information.