Comparing different reward structures – what’s actually worth your time

Last Updated: April 18, 2025

Let’s face it—the world of rewards credit cards is a jungle. You’re bombarded with flashy offers promising riches, yet drowning in fine print that makes your eyes glaze over. With hundreds of cards flaunting points systems, cashback deals, travel perks, and those pesky annual fees, how do you cut through the noise and find a card that actually delivers real value for your specific spending habits?

I’ve spent years analyzing the rewards card landscape, and here’s what I’ve discovered: most people leave serious money on the table because they’ve chosen the wrong card for their lifestyle. This comprehensive guide breaks down everything you need to know about rewards credit cards in 2025—no marketing fluff, just practical advice to help you maximize benefits without falling for common traps.

Whether you’re hunting for your first rewards card or trying to optimize your wallet, you’ll find actionable strategies that actually work in the real world. Let’s dive in.

What Exactly Are Rewards Credit Cards, Anyway?

The nuts and bolts of different rewards programs – simplified

Rewards credit cards aren’t just plastic spending tools—they’re financial products that kick back incentives for every dollar you spend. Unlike those boring standard credit cards that just give you a credit line, rewards cards put something extra in your pocket each time you swipe, tap, or click “buy now.”

The Real Deal: How These Cards Actually Work

When you use a rewards card for purchases that qualify (and yes, not all do), you earn a specified amount of rewards based on how much you spend. These goodies pile up in your account until you decide to cash in. It’s pretty straightforward math:

What you spend × Reward rate = What you earn back

For instance, drop $1,000 on a card with 2% cash back, and you’ve just scored an easy $20. Different cards offer varying reward rates, and many dish out extra rewards when you spend in specific categories—like restaurants, gas stations, or groceries.

But here’s what most people miss: the real value isn’t just in the base earning rate, but in how strategically you use different cards for different purchases. I’ll show you how to set this up without turning it into a part-time job.

The Good Stuff (Why These Cards Rock)

- Free money on autopilot: Getting value back on purchases you’d make anyway

- Welcome bonuses worth hundreds: Many cards front-load rewards with substantial sign-up bonuses

- Surprise perks most people ignore: Stuff like travel insurance, purchase protection, and extended warranties that can save you a fortune

- Credit score booster: Improve your score while banking rewards

- Choose your own adventure: Redeem rewards your way, whether that’s cash, travel, or something else

The Not-So-Great Parts (Let’s Keep It Real)

- Annual fees that sometimes bite: Many premium cards charge yearly fees that may or may not be worth it

- Interest rates that’ll make you wince: Rewards cards typically have higher APRs than basic cards

- The temptation trap: The pursuit of rewards can trick you into buying stuff you don’t actually need

- Mental gymnastics: Some rewards programs are needlessly complicated

- Rug-pull potential: Programs can change terms overnight, devaluing rewards you’ve worked hard to earn

Wait—there’s the kicker: if you carry a balance, even for a month, you’re basically lighting money on fire. The interest you’ll pay will wipe out your rewards faster than you can say “minimum payment.” So this guide assumes you’re paying in full each month (and if you’re not, focus on that first).

Breaking Down the Types of Reward Programs

Which reward structure matches your spending style?

Not all rewards are created equal. Understanding the fundamental differences between program types is critical to picking a card that aligns with your actual spending habits and redemption preferences.

Cash Back Cards: The No-BS Option

Cash back programs give you exactly what they sound like—actual cash back as a percentage of what you spend. No points-to-dollars conversion headaches, no blackout dates, just cold, hard cash (well, usually as statement credits, but you get the idea).

How They Work:

- Flat-rate cards: The lazy person’s best friend—same percentage (usually 1.5-2%) on everything you buy

- Tiered cards: Higher rates in specific categories (maybe 3% on dining, 2% on groceries, 1% elsewhere)

- Rotating category cards: Elevated rates (often 5%) on categories that shuffle quarterly

Who Should Get One: Cash back cards shine for people who value simplicity and predictability. If you hate dealing with points calculators and just want to know exactly what you’re getting, cash back is your jam. They’re particularly good for everyday spending on boring necessities.

Travel Rewards: For When You’ve Got Wanderlust

Travel rewards cards earn points or miles specifically designed for, you guessed it, travel expenses. These can offer insane value if (big if) you travel regularly and know how to work the system.

Types You’ll Encounter:

- Airline-specific cards: Earn miles for a particular airline’s frequent flyer program

- Hotel-specific cards: Rack up points for a specific hotel chain’s program

- General travel cards: Earn flexible points usable for various travel bookings

Who Should Get One: Be honest—if you’re not traveling at least a few times a year, these cards probably aren’t worth the effort. They shine for frequent travelers, especially those loyal to particular brands. If you get a little thrill from scoring a business class seat for coach prices, these cards are your ticket to the game.

Points Programs: The Swiss Army Knife Option

Points programs offer flexible rewards that can be redeemed for various options, often at different values depending on how you use them.

How They Work:

- Earn points based on spending (typically 1-5 points per dollar)

- Points value fluctuates based on redemption choice

- Many programs let you transfer points to partner airlines/hotels

Who Should Get One: Points cards are ideal for folks who want flexibility and don’t mind doing a bit of homework to maximize redemption value. They’re perfect if your redemption preferences change over time or if you sometimes travel but also want cashback options.

Hybrid Programs: Having Your Cake and Eating It Too

Some credit cards blur the lines between reward types, offering programs that combine elements from multiple reward categories.

Examples:

- Chase Ultimate Rewards points (worth more when redeemed for travel)

- American Express Membership Rewards (transfer options plus statement credits)

- Capital One miles (use for travel or cash back)

Who Should Get One: Hybrid cards work best for those who hate being boxed in and want maximum flexibility without sacrificing potential value. They’re great if your spending and redemption habits change with the seasons.

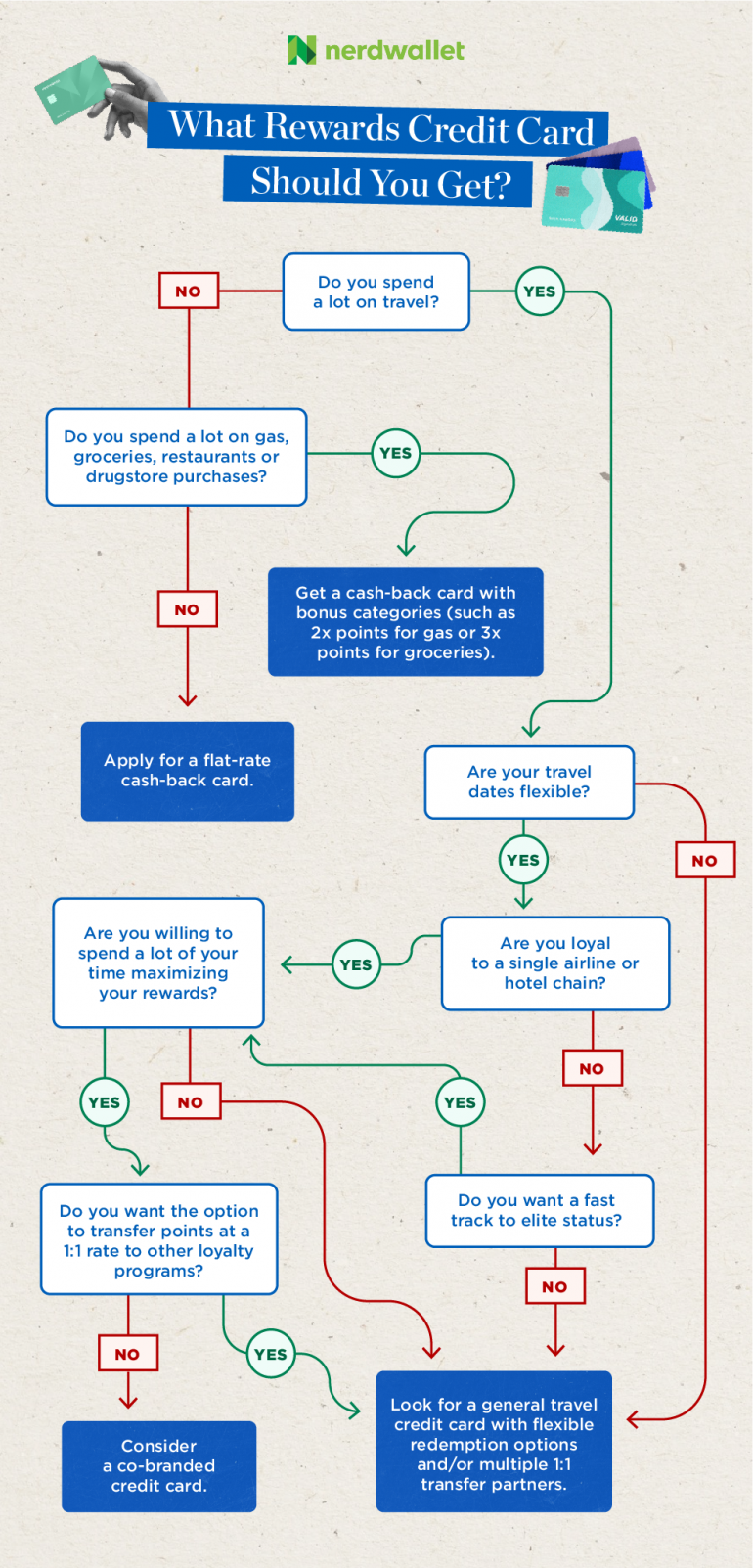

How to Actually Choose the Right Rewards Card (Without Losing Your Mind)

Decision map for finding your perfect rewards match

Decision map for finding your perfect rewards match

Forget the marketing hype—picking the right rewards card comes down to a systematic assessment of your real spending habits, reward preferences, and lifestyle. Here’s how to cut through the noise and find your perfect match.

Step 1: Get Real About Where Your Money Goes

Before you even think about which rewards card to choose, take a hard look at your last 3-6 months of spending:

- Track your major spending buckets: Sort your expenses into categories like dining, groceries, gas, travel, entertainment, etc.

- Run the numbers: Calculate monthly and yearly totals for each category

- Spot the patterns: Where does most of your money actually go?

- Think ahead: Any major purchases or life changes on the horizon?

This analysis is gold—it shows you which bonus categories will actually put money back in your pocket, not just sound good in theory.

For example, that 6% back on groceries sounds amazing, but if you eat out most nights and rarely cook, you’re better off with a card that rewards dining instead.

Step 2: Decide What Rewards You’ll Actually Use

Be brutally honest about how you’d prefer to use your rewards:

- Cash back: Do you just want money you can use for anything?

- Travel: Planning trips where airline miles or hotel points would save you serious cash?

- Brand loyalty: Do you always fly one airline or stay at the same hotel chain?

- Flexibility: Is keeping your options open important?

- Redemption frequency: Do you want quick gratification or are you saving for something big?

Remember, the “best” rewards card isn’t the one with the highest theoretical value—it’s the one you’ll actually use in ways that match your real life.

Step 3: Check Your Credit Reality

Your credit score determines which rewards cards are actually within reach:

- Excellent credit (740+): The world is your oyster—premium cards are in play

- Good credit (670-739): Most competitive rewards cards are attainable

- Fair credit (580-669): Limited options, but some rewards cards are available

- Poor credit (below 580): You might need to start with a secured card before jumping into rewards

No sense fantasizing about a card you can’t qualify for. Check your credit score first, then target cards appropriate for your credit tier.

Step 4: Do the Annual Fee Math

Many rewards cards charge annual fees—sometimes hefty ones. Here’s how to figure out if they’re worth it:

- Calculate your likely rewards based on your spending analysis

- Add the value of perks you’ll actually use (be ruthless here—airport lounge access is worthless if you never fly)

- Subtract the annual fee

- Compare with no-annual-fee alternatives

Let’s run a quick example. Say you’re looking at a card with a $95 annual fee that offers 4% on dining, 3% on travel, 2% on groceries, and 1% on everything else:

Monthly dining: $500 × 4% × 12 months = $240

Monthly travel: $200 × 3% × 12 months = $72

Monthly groceries: $400 × 2% × 12 months = $96

Everything else: $1,000 × 1% × 12 months = $120

Total annual rewards: $528

Minus annual fee: $95

Net benefit: $433

Is that extra $433 worth the mental overhead of managing another card? Only you can decide.

Step 5: Don’t Ignore the Side Benefits

Look beyond the basic rewards structure to evaluate extras that might actually save you money:

- Purchase protections: Extended warranties, theft/damage coverage

- Travel insurance: Trip cancellation, rental car coverage

- Statement credits: Annual travel credits, streaming credits

- Intro offers: 0% APR periods for large purchases

- Foreign transaction fees: Essential to consider if you travel internationally

These benefits can dramatically enhance a card’s value, especially for premium cards with higher annual fees.

Step 6: Pay Attention to Welcome Bonuses (But Don’t Be Blinded)

Most rewards cards offer introductory bonuses that can be substantial:

- What’s it worth?: Calculate the dollar value of points/miles/cash offered

- Can you hit the spend?: Make sure you can meet the minimum spend requirement without stretching your budget

- What’s the timeline?: Check how long you have to meet the spending threshold

- Any gotchas?: Review restrictions like previous cardholder rules

Welcome bonuses can provide huge upfront value—sometimes enough to justify a card for the first year even if you switch later. Just don’t let a flashy bonus seduce you into a card that’s wrong for your long-term needs.

Step 7: Think About Your Overall Card Strategy

If you already have rewards cards, consider how a new card would fit into your existing lineup:

- Fill the gaps: Look for cards that reward categories your current cards don’t cover

- Diversify rewards: Maybe add a different type of rewards program

- Plan your optimization: Figure out which card you’d use for what spending

- Be realistic: Can you actually manage multiple cards without going nuts?

For most people, a strategic combination of 2-3 cards hits the sweet spot—maximizing rewards across categories without becoming a part-time job.

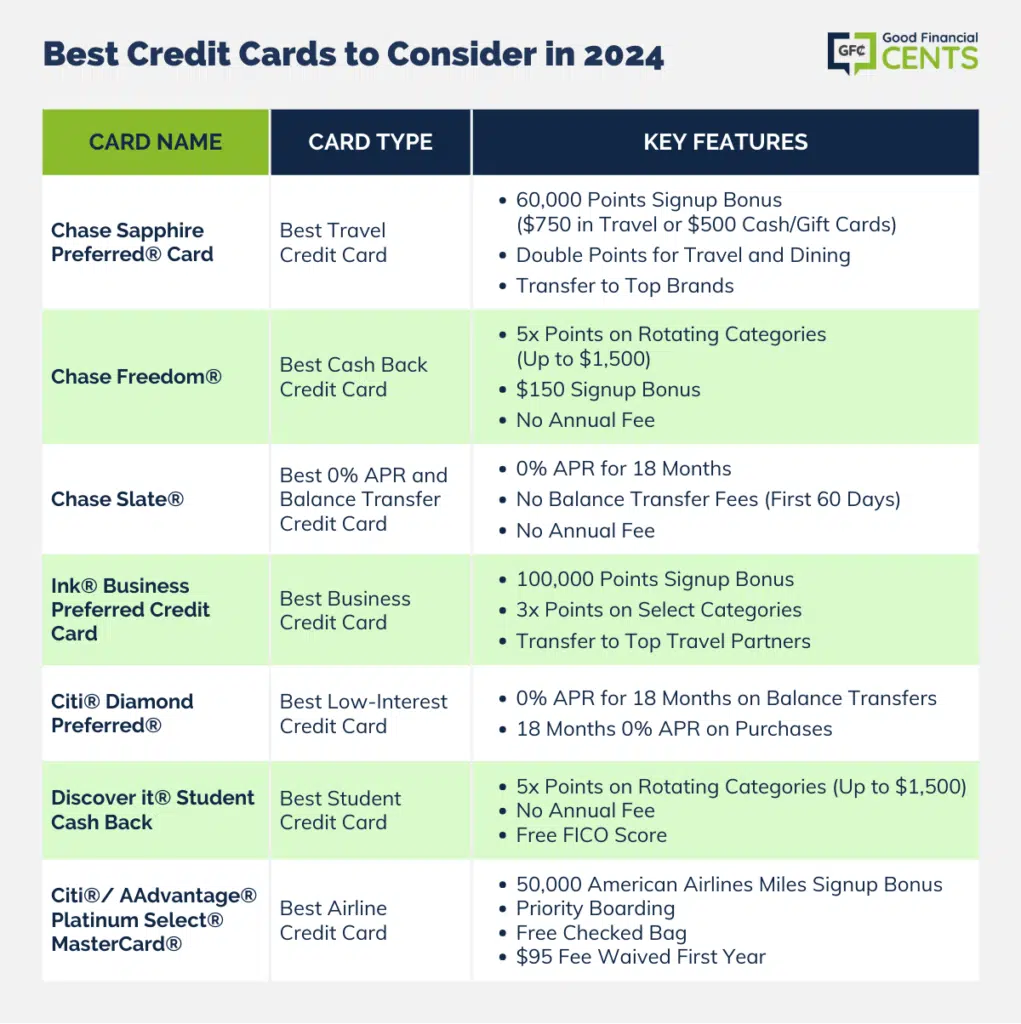

The Top Rewards Credit Cards Worth Your Time in 2025

The cream of the crop for different spending styles

I’ve analyzed dozens of reward cards, weighing earning potential, fees, bonuses, and extra perks. Here are the standout performers across categories as of April 2025.

Cash Back Champions

Citi Double Cash® Card: The Set-It-and-Forget-It Option

- The Rewards Deal: 2% total cash back on everything (1% when you buy, 1% when you pay)

- Annual Hit: $0

- Intro Sweetener: $200 cash back after spending $1,500 in first 3 months

- Hidden Gems:

- Super simple rewards structure—no categories to track

- Solid 0% intro APR on balance transfers for 18 months

- No annual fee to justify

- Perfect For: People who value simplicity above slightly higher reward rates with more hoops to jump through

Chase Freedom Unlimited®: The Hybrid Hustler

- The Rewards Deal:

- 5% back on travel booked through Chase

- 3% on dining and drugstore purchases

- 1.5% on everything else

- Annual Hit: $0

- Intro Sweetener: $200 cash back after spending $500 in first 3 months

- Hidden Gems:

- Surprising flexibility in redemption options

- Nice purchase protections most people don’t know about

- No minimum redemption amount

- Perfect For: Folks who want elevated rewards in common categories without ponying up for an annual fee

Blue Cash Preferred® from American Express: The Grocery Guru

- The Rewards Deal:

- Whopping 6% at U.S. supermarkets (up to $6,000 yearly)

- 6% on select U.S. streaming services

- 3% on transit and U.S. gas stations

- 1% everywhere else

- Annual Hit: $95

- Intro Sweetener: $350 statement credit after spending $3,000 in first 6 months

- Hidden Gems:

- Best-in-class grocery rewards rate

- Return protection that’s saved my bacon more than once

- Decent intro APR offer on purchases

- Perfect For: Families who cook at home and binge-watch their way through multiple streaming services

Travel Rewards Worth Packing

Chase Sapphire Preferred® Card: The Goldilocks Card

- The Rewards Deal:

- 5x points on Chase Travel bookings

- 3x points on dining, streaming, and online groceries

- 2x points on all other travel

- 1x point on everything else

- Annual Hit: $95

- Intro Sweetener: 75,000 points after spending $4,000 in first 3 months

- Hidden Gems:

- Points worth 25% more when redeemed through Chase Travel

- Surprisingly comprehensive travel insurance that actually works

- No foreign transaction fees

- Perfect For: Occasional to regular travelers who want flexible rewards without a premium price tag

Capital One Venture X: The Premium Travel Package

- The Rewards Deal:

- 10x miles on hotels and rental cars through Capital One Travel

- 5x miles on flights through their portal

- 2x miles on literally everything else

- Annual Hit: $395 (sounds high, but wait…)

- Intro Sweetener: 100,000 miles after spending $5,000 in first 6 months

- Hidden Gems:

- $300 annual travel credit that essentially reduces the fee to $95

- 10,000 anniversary miles each year (another $100 value)

- Airport lounge access that’ll make your traveling friends jealous

- Cell phone protection that can save you a fortune

- Perfect For: Frequent travelers who can actually use premium travel perks

American Express® Gold Card: The Foodie’s Friend

- The Rewards Deal:

- 4x points at restaurants globally (not just U.S. like some cards)

- 4x points at U.S. supermarkets (up to $25,000 yearly)

- 3x points on flights booked directly with airlines

- 1x point on the rest

- Annual Hit: $250

- Intro Sweetener: 80,000 points after spending $4,000 in first 6 months

- Hidden Gems:

- $240 in annual credits ($10/month for dining, $10/month for Uber)

- No foreign transaction fees (rare for Amex)

- Transfer points to travel partners for potentially outsized value

- Perfect For: Foodies who dine out frequently and want flexible travel rewards to match their culinary adventures

Business Rewards That Mean Business

Ink Business Cash®: The Small Biz Starter

- The Rewards Deal:

- 5% at office supply stores and on internet/cable/phone (up to $25,000)

- 2% at gas stations and restaurants (up to $25,000)

- 1% everywhere else

- Annual Hit: $0

- Intro Sweetener: $750 cash back after spending $6,000 in first 3 months

- Hidden Gems:

- Free employee cards

- Purchase protection that’s saved my business gear

- Primary rental car coverage when renting for business

- Perfect For: Small business owners with significant office expenses who don’t want to justify an annual fee

American Express Business Gold: The Category Chameleon

- The Rewards Deal:

- 4x points on your top two spending categories each month (from six options)

- 1x point on everything else

- Category spending capped at $150,000 combined annually

- Annual Hit: $295

- Intro Sweetener: 70,000 points after spending $8,000 in first 3 months

- Hidden Gems:

- Automatically adapts to your business spending patterns

- Get 25% points back when using points for flights

- No foreign transaction fees

- Perfect For: Businesses with varied expenses that change month to month

Capital One Spark Cash Plus: The High-Volume Hero

- The Rewards Deal: Simple 2% cash back on everything, no limits

- Annual Hit: $150

- Intro Sweetener: Up to $1,000 ($500 after $5k spend in first 3 months, plus $500 after $50k in first 6 months)

- Hidden Gems:

- No preset spending limit for growing businesses

- $200 annual cash bonus when you spend $200k+ annually

- Free employee cards that actually help you track spending

- Perfect For: Established businesses with high monthly expenses who want dead-simple rewards

Premium Cards for Power Users

The Platinum Card® from American Express: The Status Symbol

- The Rewards Deal:

- 5x points on flights booked directly with airlines or through Amex Travel

- 5x on prepaid hotels through Amex Travel

- 1x on everything else

- Annual Hit: $695 (gulp)

- Intro Sweetener: 125,000 points after spending $6,000 in first 6 months

- Hidden Gems:

- Over $1,500 in annual statement credits across various categories

- The most comprehensive airport lounge access of any card

- Hotel elite status with Marriott and Hilton

- Global Entry/TSA PreCheck fee credit

- Perfect For: Frequent travelers who can actually utilize the credits and luxury travel perks

Chase Sapphire Reserve®: The Travel Powerhouse

- The Rewards Deal:

- 10x points on hotels and car rentals through Chase Travel

- 5x on flights through Chase Travel

- 3x on all other travel and dining

- 1x on everything else

- Annual Hit: $550

- Intro Sweetener: 70,000 points after spending $4,000 in first 3 months

- Hidden Gems:

- $300 annual travel credit that applies automatically

- Points worth 50% more for travel through Chase

- Priority Pass membership for airport lounges

- Lyft Pink All Access for a year

- Perfect For: Serious travelers who want premium benefits with more flexible redemption options

U.S. Bank Altitude® Reserve: The Mobile Wallet Wonder

- The Rewards Deal:

- 5x points on prepaid hotels and car rentals through their Rewards Center

- 3x points on mobile wallet purchases (Apple Pay, Google Pay, etc.)

- 3x on travel

- 1x on everything else

- Annual Hit: $400

- Intro Sweetener: 50,000 points after spending $4,500 in first 90 days

- Hidden Gems:

- $325 annual travel credit (effectively making the fee $75)

- Points worth 1.5¢ each for travel redemptions

- 12 free Gogo inflight Wi-Fi passes annually

- Priority Pass with 4 free visits per year

- Perfect For: Tech-savvy spenders who use mobile wallets for everything and travel regularly

Maximizing Your Rewards Without Making It a Second Job

Squeeze more value without the headaches

Getting a rewards card is just the beginning—the real magic happens when you implement strategies to maximize both earning and redemption value. Here’s how to play the game without letting it consume your life.

The Card Combo Strategy: Your Secret Weapon

One of the most powerful tactics is strategically pairing complementary cards. This isn’t about having a wallet stuffed with plastic—it’s about using the right 2-3 cards for maximum impact.

The Famous “Trifecta” Approach

Card issuers often have products that work better together than separately. Here are the most potent combinations:

The Chase Trifecta Playbook:

- Chase Freedom Flex℠: Use exclusively for those rotating 5% categories each quarter

- Chase Freedom Unlimited®: Your go-to for non-bonus spending at 1.5% back

- Chase Sapphire Preferred® or Reserve®: Use for travel/dining, plus it lets you combine points and boost their value

The Amex Power Trio:

- American Express® Gold Card: Your dining and grocery workhorse

- The Platinum Card®: Just for flights and premium perks

- Blue Business Plus™: Covers everything else with 2x points (up to $50k yearly)

Citi’s Three-Card Monte:

- Citi Custom Cash℠: Auto-adjusts to give 5% on your highest category monthly

- Citi Double Cash®: Your everyday 2% card for non-bonus spending

- Citi Premier®: The hub for travel/dining and point transfers

With these strategic combos, you’re looking at 3-5% back on most bonus categories and at least 1.5-2% on everything else. That’s serious money back without serious complexity.

Category Hacking: Timing Is Everything

To extract maximum value from your cards:

- Plan big purchases around bonus categories: Need new appliances? Wait until home improvement hits your rotating category list.

- Set calendar alerts: Quarterly categories need activation—miss the window, miss the rewards.

- Track your spending caps: Many bonus categories have limits. Know when you’re approaching them.

- Note reset dates: Understand when your annual or quarterly limits refresh.

- Gift card arbitrage: When grocery stores are earning 5%, stock up on gift cards for places you know you’ll shop later.

Here’s what this looks like in practice:

- Groceries → Use your 6% grocery card (like Blue Cash Preferred)

- Restaurants → Pull out your dining rewards card (maybe Amex Gold)

- Gas → Grab your fuel rewards card

- Travel → Use your premium travel card with insurance benefits

- Everything else → Your trusty 2% flat-rate card

Welcome Bonus Maximization: The Quick Win

Sign-up bonuses are often worth hundreds of dollars—sometimes even a thousand or more. Here’s how to play this game:

- Space out applications: Don’t try to meet multiple spending requirements simultaneously

- Time applications around big expenses: Planning to buy furniture? Perfect time for a new card.

- Add authorized users when rewarded: Some cards give bonus points for adding users

- Know the rules around eligibility: Many issuers have specific rules about how often you can receive bonuses

- Don’t forget referrals: Earn extra points by referring friends (just don’t be that annoying person)

Points Pooling: The Family Affair

Many programs allow combining points across multiple cards or with family members:

- Household combination: Pool points with your spouse or family (where allowed)

- Business and personal merger: Combine points from your business and personal cards

- Strategic transfers: Move points to airline and hotel partners when value makes sense

- Transfer during bonuses: Watch for limited-time transfer promos offering 20-40% extra

- Prevent expiration: Use transfers strategically to keep points from dying

Redemption Secrets: Where the Real Value Hides

How you cash in your rewards can dramatically impact their value:

- Always compare options: Check the cents-per-point value across redemption choices

- Travel portal vs. transfers: Sometimes booking through the card portal beats transferring, sometimes it doesn’t

- Find award chart sweet spots: Some airline programs offer incredible value on specific routes

- Consider premium cabins: Business/first class redemptions often deliver 3-5+ cents per point

- Avoid merchandise redemptions: Generally terrible value compared to travel or cash back

Bonus Earning Hacks: Double-Dipping Delights

Boost your earnings through these often-overlooked methods:

- Shopping portals: Earn bonus points by starting at your card’s online shopping portal

- Stack rewards: Combine card rewards with store rewards and cashback apps

- Card-linked offers: Check your account for targeted offers and activate them

- Issuer-specific programs: Amex Offers, Chase Offers, etc. can provide 5-20% back at specific merchants

- Dining programs: Register your cards in airline and issuer dining programs for extra points

Annual Fee Strategy: Pay Only for Value

Make sure cards with annual fees are actually worth their cost:

- Calendar your benefits: Set reminders to use all statement credits

- Call for retention offers: Before renewal, call to see if the issuer will bribe you to stay

- Consider downgrading: Product changes to no-fee versions can preserve your credit history

- Regular value audits: Annually review if benefits still exceed the fee

- Avoid redundant benefits: Don’t pay multiple annual fees for the same perks

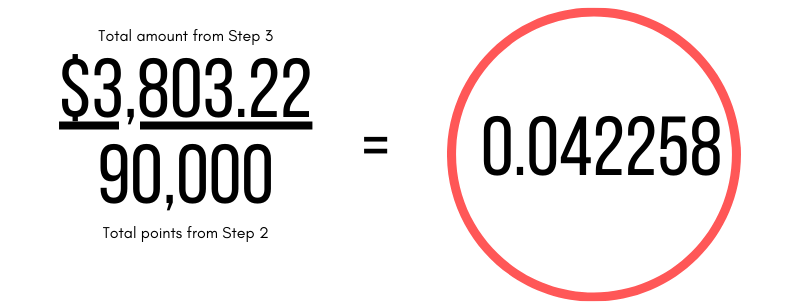

What’s Your Rewards Card Actually Worth? Let’s Do The Math

Tools to calculate your true return on spending

Tools to calculate your true return on spending

Understanding the real value of your credit card rewards helps you make smart decisions about which cards to use and how to redeem your earnings. Let’s break down the actual math behind the marketing.

The Baseline Value Formula

At its core, the value of rewards points or miles comes down to this formula:

Point Value (in cents) = Redemption Value (in dollars) ÷ Number of Points Required × 100

For example, if a $500 flight requires 40,000 points: $500 ÷ 40,000 × 100 = 1.25 cents per point

This gives you a baseline to compare different redemption options and see if you’re getting a good deal.

Cash Back: Dead Simple Math

Cash back is refreshingly straightforward—it has a fixed monetary value:

- Statement credits: Dollar for dollar (e.g., $25 cash back = $25 off your bill)

- Direct deposits: Same value as above, just deposited to your bank

- Gift cards: Sometimes offer slightly better value (e.g., $25 cash back for a $30 gift card = 1.2¢ per point)

With cash back, focus on the earning rate rather than redemption value, since the latter rarely varies.

Points Programs: Where the Math Gets Fuzzy

Flexible points programs like Chase Ultimate Rewards, American Express Membership Rewards, and Capital One Miles have values that can swing wildly depending on how you use them:

Typical Values by Redemption Type:

- Statement credits: Usually a poor value at 0.6-1.0¢ per point

- Gift cards: Slightly better at 0.7-1.1¢ per point

- Travel portal bookings: Decent value at 1.0-1.5¢ per point

- Transfers to airline/hotel partners: Potential home runs at 1.0-3.0+¢ per point

- Merchandise: Nearly always terrible value at 0.5-0.8¢ per point

To really understand what your points are worth, calculate a weighted average based on how you actually redeem them—not theoretical max values you’ll never achieve.

Airline Miles: The Wild Card

Airline miles fluctuate dramatically in value depending on how you use them:

Factors That Swing Mile Values:

- Cabin class: Economy vs. premium cabins (business/first)

- Destination: Domestic flights typically yield lower value than international

- Timing: Peak vs. off-peak travel periods

- Booking window: Last-minute redemptions can deliver outsized value

For a specific redemption, use this formula:

Mile Value = (Cash Price - Taxes/Fees You Still Pay) ÷ Miles Required × 100

For example, if a business class ticket costs $4,500 or 120,000 miles plus $150 in taxes: ($4,500 – $150) ÷ 120,000 × 100 = 3.625¢ per mile

That’s substantial value, especially compared to economy redemptions that might only yield 1-1.5¢ per mile.

Hotel Points: Location, Location, Location

Hotel points also vary based on property and timing:

Value-Changing Factors:

- Property category: Luxury properties vs. budget options

- Location: Urban centers vs. rural areas

- Seasonality: High season vs. off-season rates

- Special events: Conference periods, festivals, etc.

The basic calculation is:

Point Value = Cash Rate (with taxes/fees) ÷ Points Required × 100

Example: A hotel night costs $250 (all-in) or 20,000 points $250 ÷ 20,000 × 100 = 1.25¢ per point

Your True Rewards Rate

To understand what you’re really earning on spending, multiply:

True Rewards Rate = Earning Rate × Point Value

Example: A card earns 3 points per dollar on dining, and you typically get 1.5¢ value per point 3 × 1.5 = 4.5% effective return on dining purchases

This is why a card advertising “5X points!” isn’t necessarily better than a card offering “2% cash back”—you need to know the redemption value.

Annual Fee Break-Even Analysis

To determine if a card with an annual fee makes sense for you:

Break-Even Spending = Annual Fee ÷ (Rewards Rate - Base Card Rate)

Example: A card with a $95 annual fee earns 4% on dining vs. 2% on your no-annual-fee card $95 ÷ (0.04 – 0.02) = $4,750 annual dining spend to break even

If you spend less than that on dining annually, the no-fee card is mathematically better.

The Intangibles: Beyond the Numbers

Some card benefits defy simple valuation:

- Redemption flexibility: How easily can you use the rewards when needed?

- Award availability: Are seats/rooms available when you actually want to travel?

- Program stability: What’s the history of devaluations?

- Your preferences: Do you value premium travel over cash savings?

- Opportunity cost: Could you earn more with a different card?

These factors matter tremendously but aren’t easily quantified—you’ll need to weigh them based on your personal situation.

Track Your Real-World Value

For serious rewards maximizers, documenting your actual redemptions provides invaluable data:

- Log each redemption and calculate your cents-per-point value

- Calculate your historical average redemption value by program

- Compare your results against published valuation guides

- Adjust your strategy if you consistently get below-average value

Several apps and spreadsheet templates can help track this over time. I’ve found that my actual redemption values are often 10-15% lower than what bloggers claim is “typical”—probably because I’m redeeming for trips I actually want to take, not maximizing theoretical value.

Annual Fee Cards: Are They Actually Worth the Hit?

Breaking down when fees make sense—and when they’re a rip-off

Let’s talk about the elephant in the rewards card room: those pesky annual fees ranging from $95 to a jaw-dropping $695 or more. Are they justified by the extra benefits, or are they just padding the bank’s profits? Here’s how to figure out if you’re getting your money’s worth or getting played.

The Real Value Equation

When sizing up a card with an annual fee, consider this comprehensive formula:

True Card Value = Rewards Value + Statement Credits + Perks Value + Insurance Benefits - Annual Fee

If the final number is positive, you’re likely coming out ahead. If it’s negative, you’re essentially paying for the privilege of carrying that fancy card.

But here’s the kicker—this calculation forces you to put actual dollar values on benefits that might be somewhat subjective. Let’s break it down.

Quantifying What You’re Actually Getting

To determine if a premium card justifies its fee, analyze these components with clear eyes:

1. The Enhanced Rewards Rate

Calculate the additional rewards compared to a no-fee alternative:

Extra Rewards = Annual Spending × (Premium Card Rate - No-Fee Card Rate)

For instance, if you drop $12,000 yearly on dining:

- Fancy premium card: 4% rewards = $480 value

- Basic no-fee card: 1.5% rewards = $180 value

- Additional value: $300

That $300 difference helps offset the annual fee—but only if you actually spend heavily in that category.

2. Statement Credits: The Shell Game

Many premium cards offer statement credits for specific purchases:

- Annual travel credits: Money back for flights, hotels, etc.

- Airline incidental credits: Reimbursement for baggage fees and in-flight purchases

- Dining credits: Monthly kickbacks at select restaurants

- Shopping credits: Statement credits for specific retailers

- Entertainment credits: Credits for streaming, events, etc.

Here’s the truth most blogs won’t tell you: only count credits for things you’d actually buy anyway. That $240 in Uber credits isn’t worth $240 if you normally only spend $100 a year on rideshares.

3. Travel Perks: What Are They Really Worth?

Be honest about how much you value these benefits based on actual usage:

- Airport lounge access: Worth $20-50 per visit × how often you’ll actually use it

- Hotel elite status: Roughly $10-25 per night × your annual hotel stays

- Airline companion certificates: The market value of a typical companion ticket you’d use

- Free checked bags: $30-60 per bag × number of flights yearly

- Priority boarding: $15-20 per flight (if it actually matters to you)

The key is realistic usage estimates. That Priority Pass membership isn’t worth a penny if you never set foot in an airport lounge.

Real-World Examples: Annual Fee Math in Action

Let’s examine three common scenarios to illustrate when annual fees make sense:

Scenario 1: The Casual Traveler with Chase Sapphire Preferred ($95 fee)

Annual Spending:

- $6,000 on travel (3x points = 18,000 points)

- $8,000 on dining (3x points = 24,000 points)

- $12,000 on other purchases (1x points = 12,000 points)

Total: 54,000 points × 1.25¢ (Chase portal value) = $675

Additional Benefits:

- Trip cancellation insurance: ~$150 value (based on typical policy costs)

- Primary rental car coverage: ~$100 value (compared to standalone policies)

- No foreign transaction fees: ~$60 value (on $2,000 international spend)

Total Value: $985 – $95 fee = $890 net benefit

This card is a no-brainer for this spending pattern.

Scenario 2: The Road Warrior with The Platinum Card from American Express ($695 fee)

Annual Spending:

- $10,000 on flights directly with airlines (5x points = 50,000 points)

- $30,000 on other purchases (1x points = 30,000 points)

Total: 80,000 points × 1.5¢ (transfer partner average) = $1,200

Statement Credits:

- $200 airline fee credit

- $200 hotel credit

- $240 digital entertainment credit

- $200 Uber credit

- $189 CLEAR Plus credit

Total Credits: $1,029 (assuming 100% utilization)

Other Benefits:

- Airport lounge access: $450 value (15 visits × $30)

- Hotel elite status: $250 value

- Global Entry credit: $20 value (amortized over 5 years)

- Various travel protections: $200 value

Total Value: $2,949 – $695 fee = $2,254 net benefit

Whoa—huge value, but only if you’re a frequent traveler who can actually use the credits. Missing even a few of those statement credits dramatically reduces the value proposition.

Scenario 3: The Family Shopper with Blue Cash Preferred ($95 fee)

Annual Spending:

- $6,000 on U.S. supermarkets (6% cash back = $360)

- $3,000 on U.S. gas stations (3% cash back = $90)

- $2,000 on transit (3% cash back = $60)

- $1,500 on streaming services (6% cash back = $90)

- $12,000 on other purchases (1% cash back = $120)

Total Cash Back: $720

Comparison with No-Fee Alternative:

- Blue Cash Everyday (no annual fee): Same spending would earn about $435

Net Benefit: $720 – $435 – $95 fee = $190

Good value for a typical family, but notice how the math would change dramatically if grocery spending dropped below $4,000 annually.

Your Annual Fee Decision Framework

Ask yourself these questions before committing to a card with an annual fee:

- Will you use it enough? Calculate the minimum spending needed to break even

- Will you actually use the key benefits? Be brutally honest about which perks you’ll utilize

- Do you personally value the specific benefits? Airport lounges might be worthless to you even if others value them

- Are the card’s features unique? Some benefits can’t be replicated with no-fee cards

- Will you remember to use all the credits? Statement credits provide zero value if forgotten

- Is there a no-fee downgrade option? Some issuers allow downgrades if value diminishes

- Does it complement your existing cards? Consider your overall card strategy

Annual Fee Workarounds

Not thrilled about fees but want premium benefits? Try these approaches:

- Ask for retention offers: Call before renewal to request a bonus or fee waiver

- Look for first-year waivers: Many cards waive the fee for year one

- Military benefits: Several issuers waive fees for active military

- Bank relationship discounts: Some banks reduce fees for preferred customers

- Authorized user route: Join someone else’s account for reduced cost

- Downgrade/upgrade strategy: Start with no-fee version, upgrade for bonus, then downgrade

When No-Annual-Fee Cards Make More Sense

Despite potential value in premium cards, no-fee options are often smarter in these situations:

- Infrequent card users: Low spending can’t justify fees

- Credit builders: Focus on building history before optimizing rewards

- Debt carriers: If you ever carry a balance, prioritize lower APR over rewards

- Simplicity seekers: Those who hate tracking benefits and credits

- Homebodies: Many premium benefits center on travel perks

The bottom line? Annual fees can be worth it—but only if they align with your actual spending patterns and lifestyle. Don’t pay for premium benefits you’ll admire but never use.

Rookie Mistakes That Kill Your Rewards Value

Common pitfalls that slash your earnings

Even savvy rewards card users sometimes shoot themselves in the foot. Understanding these common traps can help you maximize value while avoiding costly blunders that diminish or completely wipe out your card benefits.

Financial Faceplants

The Cardinal Sin: Carrying a Balance

This is the granddaddy of all rewards card mistakes. Rewards cards typically have higher interest rates, which can quickly obliterate any benefits:

- The brutal math: A 20% APR will always crush even the most generous 5% rewards rate

- A painful example: On a $2,000 balance carried for a year:

- Interest paid: $400

- Rewards earned (at 2%): $40

- Net loss: $360

That’s like paying someone $360 for the privilege of getting $40 back. Yikes.

Reality check: Always pay your balance in full. If you need to carry a balance, use a low-interest card instead of a rewards card.

The Illusion of “Free Money”

Increasing spending just to earn more rewards is like drinking salt water to quench your thirst:

- The psychology trap: “I’ll get 5% back” becomes an excuse for unnecessary purchases

- Hard truth: 5% back still means you’re spending 95% out of pocket

- Warning signs: Using cards near their limits, buying stuff you wouldn’t otherwise get

Sanity check: Only put planned, budgeted expenses on rewards cards. The best rewards come from spending you’d do anyway.

The Annual Fee Autopilot

Failing to reassess whether a card still delivers value year after year:

- First-year mirage: Welcome bonus often dwarfs the fee initially

- Subsequent reality: Without that fat signup bonus, the math changes dramatically

- The inertia problem: Many people keep paying fees out of habit

Action plan: Calendar the date before each annual fee hits to reevaluate if the card still earns its keep.

Strategic Stumbles

Card Mismatch Syndrome

Choosing rewards cards that don’t align with your actual spending patterns:

- Classic example: Getting an airline card when you rarely leave town

- Category blindness: Ignoring where your money actually goes

- Emotional choices: Picking cards based on flashy marketing rather than value

Better approach: Analyze your spending for at least 2-3 months before choosing a rewards card. Target cards that reward your top 2-3 spending categories.

Bonus Category Blindness

Failing to optimize which card you use for each purchase:

- Money left behind: Using a 1.5% flat-rate card for purchases that could earn 4-5% elsewhere

- Activation amnesia: Forgetting to enroll in rotating quarterly categories

- Cap unawareness: Not tracking spending limits on bonus categories

Simple fix: Create a quick reference system (maybe a note in your wallet or phone) to ensure you’re using the optimal card for each purchase type.

Reward Expiration Oversight

Allowing hard-earned rewards to vanish due to inactivity or policy changes:

- Inactivity timeouts: Many programs wipe out points after 12-24 months without activity

- Program changes: Devaluations or terminations can render points worthless overnight

- Closure casualties: Points often disappear when accounts are closed

Prevention plan: Track expiration dates in a spreadsheet or app. Set calendar reminders for minimum activity requirements.

Redemption Regrets

Settling for Low-Value Redemptions

Cashing in rewards for less than their optimal value:

- Merchandise mistake: Often valued at just 0.5-0.8¢ per point

- Statement credit surrender: Sometimes valued lower than travel redemptions

- Gift card gaffes: Usually poor value unless offered at a bonus rate

Strategy shift: Learn the highest-value redemption options for each program. Be patient and wait for good opportunities rather than grabbing the first option.

Transfer Partner Ignorance

Missing chances to leverage transfer partners:

- Direct redemption defaults: Often provide lower value than strategic transfers

- Bonus blindness: Missing limited-time bonuses offering 20-40% extra points

- Sweet spot oversight: Overlooking high-value partner redemptions

Knowledge is power: Research transfer partners and their award charts. Watch for transfer bonuses and special promotions.

The Point Hoarder Mentality

Accumulating massive point balances without a redemption plan:

- Devaluation risk: Programs regularly dilute point values over time

- Opportunity cost: Points sitting unused provide zero actual value

- Psychological trap: Points become “too valuable to use” (like saving the good china forever)

Reality check: Set specific redemption goals. Maintain reasonable point balances while regularly using rewards for tangible value.

Administrative Accidents

Minimum Spend Misses

Failing to meet spending thresholds for welcome bonuses:

- Calendar confusion: Misunderstanding when the spending window starts/ends

- Tracking errors: Not monitoring progress toward minimum spend

- Return surprises: Product returns can reduce qualifying spend after the fact

Simple solution: Create a tracking system for bonus requirements. Set calendar alerts for deadline dates.

Benefit Blindness

Paying for benefits you already have through your credit cards:

- Travel insurance redundancy: Purchasing separate policies when card coverage works

- Rental car double-coverage: Paying for agency coverage when your card provides primary coverage

- Subscription oversights: Not using monthly or annual statement credits

Fix: Create a benefits inventory for each card. Set calendar reminders to use time-sensitive perks.

Application Timing Errors

Poor planning of credit card applications:

- Chase 5/24 rule snags: Being declined because of too many recent applications

- Velocity violations: Applying for multiple cards from the same issuer too quickly

- Credit score impacts: Too many hard inquiries in a short period

Strategy: Research issuer rules before applying. Space applications appropriately (generally 3-6 months apart).

Program Pitfalls

Devaluation Denial

Failing to adapt strategy when programs change:

- Award chart ambushes: Programs frequently increase point requirements for redemptions

- Benefit erosion: Premium perks being quietly eliminated or downgraded

- Category shifts: Changes to bonus earning categories

Stay informed: Follow blogs and forums covering reward programs. Be ready to pivot your strategy when program terms change.

Shopping Portal Oversight

Missing out on easy additional points:

- Double-dip opportunities: Earn portal points plus card rewards

- Significant multipliers: Portals often offer 2-10x additional points

- Promotion blindness: Missing limited-time increased earning rates

Simple habit: Check shopping portals before making online purchases. Consider using a shopping portal aggregator site.

Card-Linked Offer Ignorance

Failing to activate and use targeted offers:

- Issuer offer oversights: Programs like Amex Offers and Chase Offers provide statement credits or bonus points

- Dining program omissions: Many cards can be linked to airline and hotel dining programs

- Merchant-specific misses: Targeted offers for specific retailers

Quick win: Regularly check your online account for new offers. Set a monthly reminder to review available promotions.

Your Burning Questions About Rewards Cards, Answered

Straight answers to common rewards card questions

The Basics You’ve Been Too Embarrassed to Ask

“Do rewards cards affect my credit score differently than regular cards?”

Nope, rewards credit cards impact your score exactly the same way as regular cards. The factors that influence your score—payment history, credit utilization, length of history, new applications, and credit mix—apply equally to all card types.

That said, there’s an indirect effect: rewards cards might tempt you to carry higher balances to earn more points, potentially increasing your credit utilization ratio. And that can hurt your score.

“Can I have multiple rewards cards from the same issuer?”

Absolutely! Most issuers let customers hold several rewards cards simultaneously. This strategy, often called “card stacking,” can be brilliant for maximizing rewards across different spending categories.

Just be aware that issuers may have rules about how many cards you can have, how frequently you can apply, or your eligibility for multiple welcome bonuses. For example, American Express typically limits customers to one welcome bonus per card product per lifetime.

“What happens to my rewards if I close my credit card?”

In most cases, closing a credit card means kissing your unredeemed rewards goodbye. Here’s the breakdown:

- Co-branded airline/hotel cards: Points already transferred to the loyalty program usually survive

- Issuer-specific programs: Points typically vanish unless you have another active card in that program

- Grace periods: Some issuers offer 30-60 days after closure to use remaining rewards

- Account closure: Nearly all programs forfeit unredeemed rewards when you shut down an account

Pro tip: Always redeem or transfer valuable rewards before closing a card.

“Are credit card rewards taxable?”

Generally, no. The IRS typically views credit card rewards as rebates or discounts on purchases rather than income, so they’re usually not taxable.

There are exceptions, though: sign-up bonuses earned without spending requirements (rare), referral bonuses, and rewards earned from business spending that you’ve deducted as a business expense might be taxable. When in doubt, ask a tax pro.

The Earning Questions Everyone Has

“How quickly do rewards post to my account?”

Timing varies by issuer:

- Statement cycle: Most banks award rewards after each billing cycle closes

- Transaction posting: Some issuers credit rewards shortly after purchases clear

- Welcome bonuses: These typically appear 6-8 weeks after meeting spending requirements

- Special promos: May follow unique timelines specified in the offer terms

Most issuers now show pending rewards in your online account before they’re officially credited, which takes some of the mystery out of the process.

“Do all purchases earn rewards points?”

Not even close. Common exclusions include:

- Cash-like transactions: Cash advances, money orders, cryptocurrency

- Balance transfers: Moving debt between cards

- Peer-to-peer payments: Person-to-person transfers

- Financial payments: Some mortgage or loan payments

- Tax payments: Though some cards do allow this

Beyond these, purchases must be correctly categorized in payment systems to trigger bonus categories. Sometimes expected bonuses don’t materialize because a merchant is classified differently than you’d expect.

“How are purchases categorized for bonus cash back?”

It all comes down to the merchant category code (MCC)—a classification assigned to each business:

- Payment networks: Visa, Mastercard, Amex, and Discover assign these codes

- Business type: Based on the merchant’s primary business, not what you actually buy

- Categorization surprises: Some businesses might be classified differently than you’d expect

For example, that gas station convenience store might be coded as a “gas station” or a “grocery store.” Card issuers don’t control these classifications and generally can’t override them for specific transactions.

“Can I earn rewards on purchases made by authorized users?”

Yes! Purchases made by authorized users typically earn rewards at the same rates as the primary cardholder’s purchases:

- Same earning rates: Equal rewards for all users

- Shared rewards pool: All earnings go into the same account

- Category limits: Authorized user spending counts toward category caps

- Redemption control: Usually only the primary cardholder can cash in rewards

This makes adding authorized users a smart way to rack up rewards faster, especially for household expenses. Just remember that you’re on the hook for all charges they make.

“Do returns affect my rewards earnings?”

Absolutely. When you return an item, the issuer claws back the rewards:

- Reward reversal: The cash back or points earned on the original purchase gets deducted

- Timing mismatches: May happen in a different billing cycle than the original purchase

- Redemption complications: If you’ve already used the rewards, they’ll deduct from future earnings

This ensures rewards only stick around for purchases you actually keep.

Money and Credit Questions

“Do cash back credit cards have higher interest rates?”

Yes, rewards cards (including cash back) generally carry higher APRs than basic cards:

- Rate premium: Typically 2-5 percentage points higher than no-frills cards

- Economics: The higher rates help fund those sweet rewards programs

- Target market: Rewards cards aim at consumers who spend more

- Low-rate alternatives: If you carry balances, low-interest cards are almost always better

This highlights why paying in full each month is so crucial with rewards cards. Interest charges quickly devour any rewards you earn.

“Will applying for a rewards card tank my credit score?”

It will have an impact, but usually a modest one:

- Hard inquiry: Expect a small, temporary dip (about 5-10 points)

- New account effect: Reduces your average account age if approved

- Available credit boost: Additional credit line can improve utilization ratio

- Long-term benefit: On-time payments strengthen your score over time

For most people with established credit, the initial negative impact is minor and temporary, while the long-term effect is often positive if you manage the card responsibly. Multiple applications in a short period, however, can cause more significant damage.

“Is paying an annual fee for a rewards card ever worth it?”

It absolutely can be, depending on your spending and the card’s benefits:

- Break-even analysis: Calculate how much you must spend to offset the fee

- Net reward comparison: Compare total rewards minus fee against no-fee alternatives

- Benefit valuation: Consider additional perks beyond the basic rewards rate

- Usage alignment: Assess whether your spending patterns match the card’s strengths

For example, the Blue Cash Preferred® Card ($95 annual fee) makes sense for someone spending over $3,200 annually at U.S. supermarkets compared to its no-fee version, but might be a waste for a person who rarely cooks at home.

“Does redeeming rewards generate taxable income?”

In most cases, no. The IRS generally considers rewards as purchase rebates rather than income, so they’re typically not taxable.

Exceptions exist, though:

- No-spend bonuses: Rewards earned without spending (rare these days)

- Business card rewards: Different tax implications may apply for business expenses

- Referral bonuses: Rewards for referring others might be taxable

When in doubt, consult a tax professional about your specific situation.

Strategy Deep Dives

“Is it better to have multiple cash back cards or one premium card?”

The answer depends on your spending patterns and tolerance for complexity:

Multiple card advantages:

- Higher effective rewards across various categories

- Ability to maximize different bonus categories

- Often lower overall annual fees

- Backup options if one card isn’t accepted

Single premium card advantages:

- Simplicity of management

- Consolidated rewards in one program

- Often superior additional benefits

- Less mental load when making purchases

For many people, a strategic combination of 2-3 complementary cards hits the sweet spot—maximizing rewards without creating a management nightmare.

“How do I maximize value with rotating category cards?”

To optimize cards like Chase Freedom Flex℠ or Discover it® Cash Back:

- Set calendar reminders for quarterly activation

- Plan major purchases around relevant categories

- Buy gift cards for future use during bonus periods

- Track spending to hit but not exceed category limits

- Pair with other cards for non-category purchases

This approach requires some effort but can yield significantly higher rewards for those willing to stay organized.

“Should I choose cash back or a 0% APR offer?”

It depends on your financial situation:

- Carrying a balance: If financing a large purchase or transferring a balance, prioritize 0% APR

- Paying in full monthly: If you never carry a balance, focus on rewards

- Hybrid needs: Some cards offer both rewards and 0% intro periods

- Long-term outlook: Consider both immediate needs and ongoing benefits

The interest savings from a 0% offer typically dwarf potential rewards if you’ll be carrying a significant balance. For example, $5,000 carried for 15 months at 18% APR would rack up about $1,125 in interest—far more than typical rewards earnings.

“How do cash back cards compare internationally?”

Cash back cards vary significantly between countries:

- Reward rates: U.S. cards typically offer higher percentages than international equivalents

- Foreign transaction fees: Many U.S. cash back cards charge 3% on international purchases

- Acceptance limitations: Some cash back cards have lower acceptance internationally

- Alternative structures: Some countries favor points or loyalty programs over cash back

If you travel internationally often, look specifically for cash back cards with no foreign transaction fees, or consider a dedicated travel card for overseas use.

The Bottom Line on Rewards Credit Cards

Rewards credit cards can be powerful financial tools when used strategically. By understanding different reward structures, choosing cards aligned with your actual spending, and implementing smart maximization techniques, you can earn substantial returns on purchases you’d make anyway.

The ideal approach varies based on your habits, spending patterns, and preference for simplicity versus optimization. For some, a single flat-rate card provides satisfying rewards with minimal effort. For others, a carefully chosen portfolio of 2-3 complementary cards can significantly boost total returns while keeping complexity manageable.

Whether you’re just starting with rewards cards or fine-tuning an existing strategy, remember these core principles:

- Always pay balances in full to avoid interest charges

- Choose cards rewarding your actual spending patterns, not theoretical ones

- Be strategic about category bonuses

- Develop a thoughtful redemption plan

- Regularly reassess your card portfolio as your needs change

With the right approach, rewards cards deliver meaningful value that adds up substantially over time—without requiring a degree in points optimization or turning credit card management into your new hobby.

Disclaimer: Credit card terms and offers change frequently. Information in this guide is accurate as of April 18, 2025. Always verify current details directly with card issuers before applying. This guide provides information only and shouldn’t be considered financial advice.

AFFILIATE DISCLOSURE: CreditCardWisdom.com may receive compensation when visitors apply through our links and are approved. While we provide comprehensive information about available cards, our reviews highlight cards from our partners. Our content represents our honest opinions regardless of compensation arrangements.