Balance Transfer Credit Cards: Complete Guide for Debt Reduction (2025)

Hey friend! If you’re staring at a mountain of high-interest credit card debt and feeling overwhelmed by those monthly payments, I’ve got some good news for you. You’re not alone—and there’s a powerful tool that could help you break free from the debt cycle faster than you might think.

Balance transfer credit cards might sound like just another financial product, but when used correctly, they can be your secret weapon for crushing debt and saving hundreds (or even thousands) of dollars in interest. Today, I’m walking you through everything you need to know about these valuable tools—from how they work to the best options available in 2025.

“The borrower is slave to the lender.” We’ve all heard this truth, but what if I told you that you could use a strategic balance transfer to actually break those chains faster? Not by borrowing more, but by being smarter with what you already owe.

What Are Balance Transfer Credit Cards?

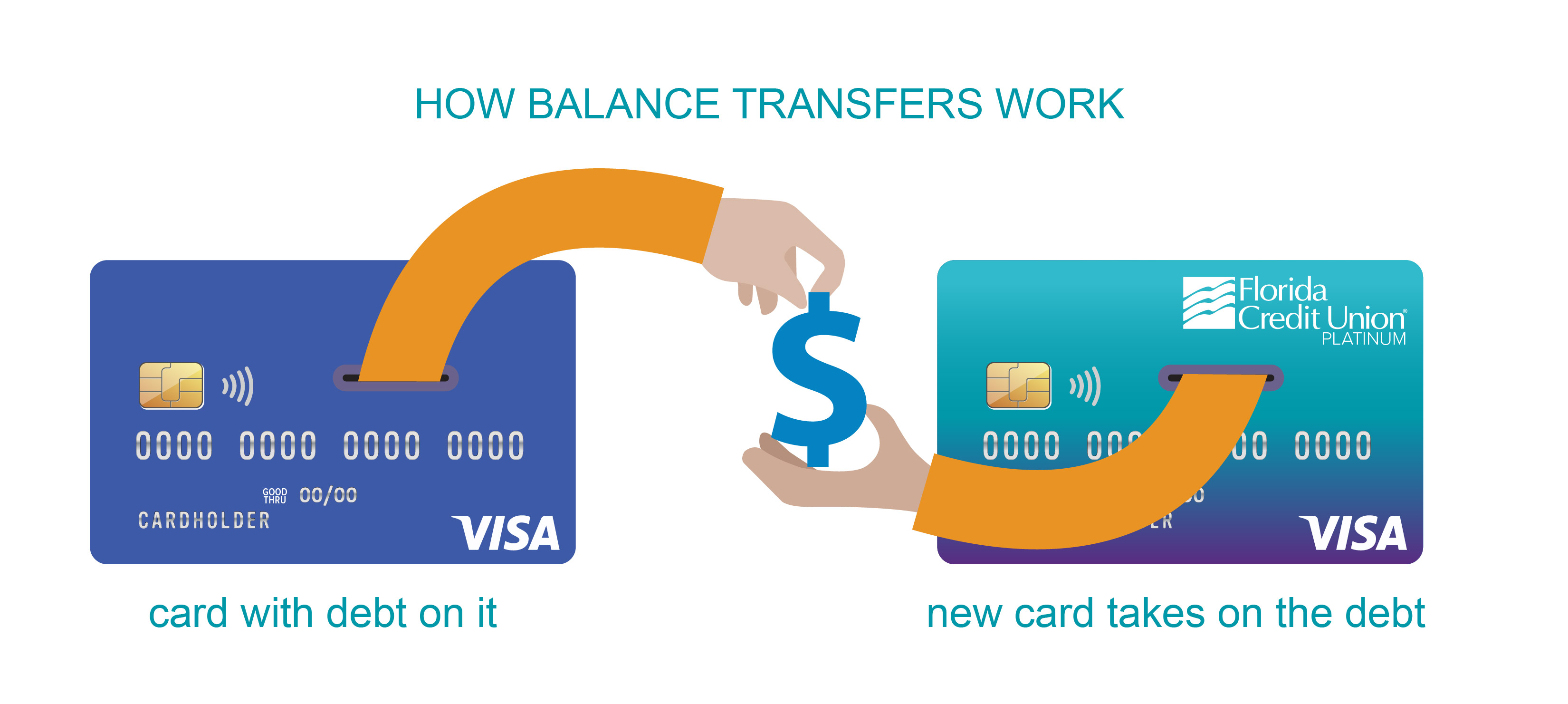

Let’s start with the basics. A balance transfer credit card is designed specifically to help you move existing debt from one (or multiple) high-interest credit cards to a new card with a significantly lower interest rate—often 0% for an introductory period.

Illustration of how balance transfers work

Think of it like this: You’ve been carrying around a 50-pound backpack (your debt with 18-24% interest) on a hike that seems to never end. A balance transfer card gives you the chance to trade that heavy backpack for a much lighter one (same debt but with 0% interest) for a specific distance of your journey (the promotional period). This lighter load means you can move faster toward your destination of being debt-free!

Key Benefits of Balance Transfer Cards

- Interest Savings: The most obvious benefit—paying little to no interest during the promotional period can save you hundreds or thousands of dollars.

- Debt Consolidation: Combine multiple card balances into one payment with one due date.

- Accelerated Payoff: With 100% of your payment going to principal (during 0% periods), you can eliminate debt faster.

- Simplified Finances: Managing one payment instead of several reduces stress and chances of missed payments.

But here’s the truth I want you to understand from the beginning: balance transfer cards are tools—not magic wands. They won’t solve your debt problems automatically. They work best when paired with a solid budget, intentional spending habits, and a commitment to not adding new debt. This is about creating a pathway to freedom, not just shuffling debt around!

How Do Balance Transfer Cards Work?

Before you dive into the balance transfer world, it’s important to understand exactly how these cards operate. Let’s break it down into simple terms.

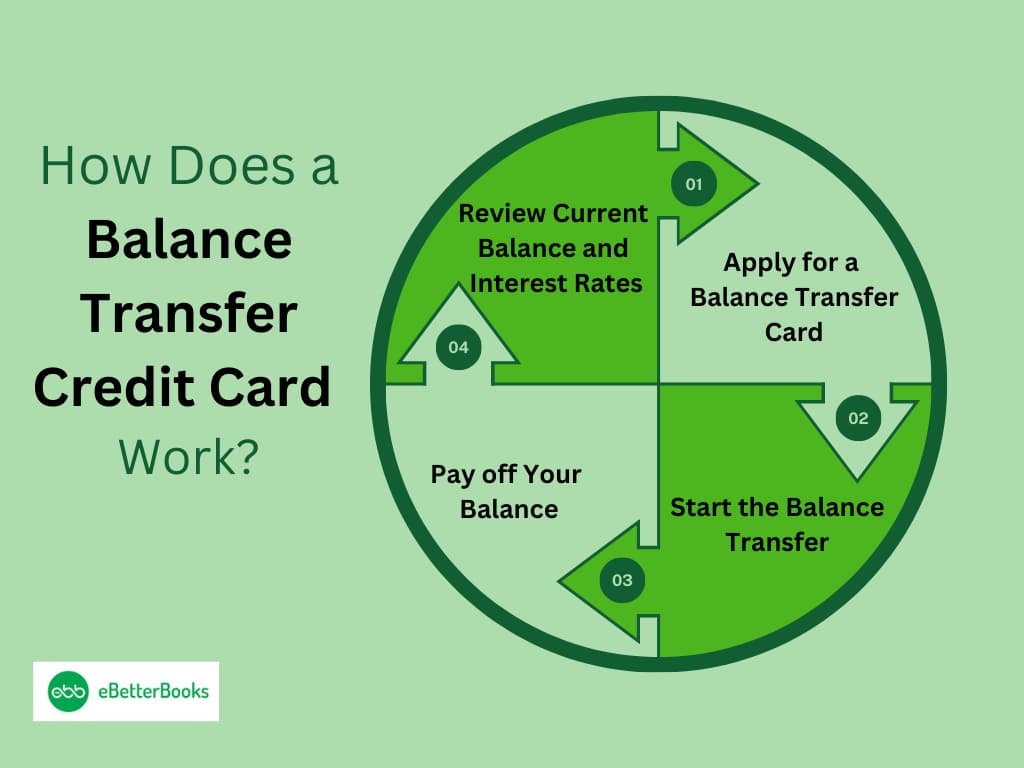

Step-by-step balance transfer process visualization

The Balance Transfer Process

- You apply for a balance transfer credit card (more on how to choose the right one later).

- Once approved, you provide the new card issuer with information about your existing debt: the credit card account numbers and the amounts you want to transfer.

- The new card issuer pays off those debts on your behalf, essentially “transferring” what you owe to the new card.

- You now make payments to the new card issuer, typically under much more favorable terms during the promotional period.

- The clock starts ticking on your promotional period (typically 12-21 months), during which you’re aiming to pay off as much of the balance as possible.

Key Terms to Understand

| Term | What It Means | Why It Matters |

|---|---|---|

| Introductory APR | The promotional interest rate (often 0%) that applies for a limited time. | This is the “breathing room” that allows you to make progress on your debt without interest piling up. |

| Promotional Period | The length of time the introductory APR lasts (typically 6-21 months). | This is your window of opportunity—every payment during this time goes much further. |

| Balance Transfer Fee | A one-time fee charged to transfer your balance, typically 3-5% of the transferred amount. | This is the cost of admission—you need to make sure the interest savings outweigh this fee. |

| Regular APR | The interest rate that applies after the promotional period ends. | This is the “deadline pressure”—ideally, you want to pay off your balance before this kicks in. |

| Transfer Window | The timeframe during which you can make transfers at the promotional rate (often 60-120 days). | Don’t miss this window! Transfers made after this period won’t qualify for promotional terms. |

ACTION STEP

Before applying for any balance transfer offer, calculate how much you’ll need to pay each month to eliminate the debt before the promotional period ends. This becomes your monthly target payment. For example, if you transfer $6,000 and have an 18-month promotional period, you’d need to pay at least $333 monthly to pay it off completely (not counting any transfer fees).

Best Balance Transfer Offers in 2025

Now for the exciting part! Let’s look at some of the best balance transfer options currently available. I’ve focused specifically on cards that offer the most value for people trying to get out of debt—with special attention to no-fee options and those with the longest 0% periods.

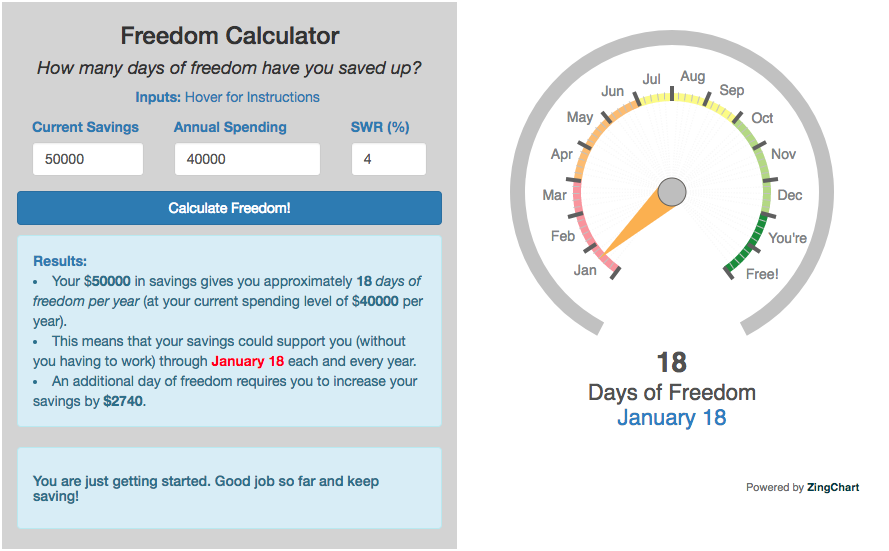

Visualizing how different balance transfer options affect your path to financial freedom

Top No-Fee Balance Transfer Cards

While most balance transfer cards charge 3-5% of the transferred amount as a fee, these rare gems don’t charge a fee for transfers, making them especially valuable if you’re tight on cash:

| Card | Intro APR Period | Transfer Fee | Regular APR | Key Feature |

|---|---|---|---|---|

| BECU Low Rate Credit Card | 0% for 12 months | $0 | 12.50% – 17.99% Variable | Credit union card with no annual fee and no transfer fees |

| Navy Federal Credit Union Platinum | 0.99% for 12 months | $0 | 8.99% – 18.00% Variable | For military families; one of the lowest post-promo APRs |

| CorTrust Bank CorPlatinum | 0% for 6 months | $0 | 11.65% – 20.15% Variable | Low ongoing APR if you can pay off quickly |

Longest 0% Intro APR Cards

If you need more time to pay off your debt and are willing to pay a transfer fee for a longer 0% period, these cards offer the most breathing room:

| Card | Intro APR Period | Transfer Fee | Regular APR | Key Feature |

|---|---|---|---|---|

| Wells Fargo Reflect Card | 0% for 21 months | 3% intro fee, then 5% | 17.24% – 28.99% Variable | Longest intro period currently available |

| Citi Simplicity Card | 0% for 21 months on transfers | 3% intro fee, then 5% | 18.24% – 28.99% Variable | No late fees or penalty APR |

| Citi Double Cash Card | 0% for 18 months | 3% intro fee (min $5) | 18.24% – 28.24% Variable | 2% cash back on all purchases after debt is paid |

Best Overall Value Cards

These cards balance a good promotional period with reasonable fees and other benefits:

| Card | Intro APR Period | Transfer Fee | Regular APR | Key Feature |

|---|---|---|---|---|

| BankAmericard Credit Card | 0% for 18 months | 3% intro fee (min $10) | 16.24% – 26.24% Variable | Lower transfer fee than many competitors |

| Chase Freedom Unlimited | 0% for 15 months | 3% intro fee (min $5) | 19.24% – 27.99% Variable | Strong rewards structure after debt payoff |

| U.S. Bank Shield Visa Card | 0% for 18 months | 3% intro fee (min $5) | 18.74% – 28.74% Variable | Good security features and credit monitoring |

Important Note on 2025 Trends

According to LendingTree’s 2025 Balance Transfer Credit Card Report, fees are trending upward. Now, 44% of 0% balance transfer offers come with a one-time fee of either 4% or 5%, while 51% charge a 3% fee. This is why grabbing a no-fee or low-fee option can be especially valuable.

Additionally, most promotional periods (82%) are currently in the 12-15 month range, making those 18+ month offers particularly noteworthy.

ACTION STEP

Make a list of your current credit card balances, their interest rates, and minimum payments. Then use an online balance transfer calculator to compare how much you’d save with each of these card options, taking into account their different promotional periods and transfer fees.

The Balance Transfer Card Application Process

Now that you’ve identified which card might work best for your situation, let’s talk about how to apply—and most importantly, how to maximize your chances of approval.

Financial freedom concepts including debt reduction strategies

What You’ll Need for Your Application

- Personal information: Name, address, phone number, email, Social Security number, date of birth

- Financial information: Annual income, employment status, monthly housing payment

- Existing card information: Account numbers and payment addresses for the balances you want to transfer

Credit Score Requirements

Let’s talk about what most people wonder but don’t always ask: “What are my chances of getting approved?”

Credit Score Ranges for Balance Transfer Cards:

- Excellent (740+): Highest approval odds for premium cards with the best terms

- Good (670-739): Good chances for most balance transfer cards

- Fair (580-669): Limited options, but some cards available with shorter promotional periods

- Poor (Below 580): Very difficult to qualify; may need to consider other debt reduction strategies first

Most of the top balance transfer cards—especially those with the longest 0% periods—typically require a good to excellent credit score (670+). However, don’t let that discourage you if your score isn’t quite there yet. Some issuers offer cards specifically for those with fair credit, and credit unions often have more flexible approval criteria for their members.

Strategic Application Tips

5 Ways to Improve Your Approval Chances

- Check your credit report first and dispute any errors (even a small score boost can help).

- Don’t apply for multiple cards at once—this creates hard inquiries that can temporarily lower your score.

- Include all eligible income on your application (many people underreport).

- Pay down existing balances if possible before applying to improve your debt-to-income ratio.

- Consider becoming a member of a credit union that offers balance transfer cards with more flexible approval criteria.

After You’re Approved

Once you receive approval, you’ll typically need to:

- Activate your new card

- Initiate the balance transfer (either online, by phone, or via a form)

- Continue making at least minimum payments on your old cards until you confirm the transfers have been completed

- Verify that the transfers have been processed correctly

Important Transfer Timeline Warning

Balance transfers aren’t instant! They typically take 5-14 days to complete. Don’t wait until the last minute before a payment is due on your old card to initiate a transfer, or you might get hit with a late fee or miss the promotional window entirely.

ACTION STEP

Before applying, check your credit score using a free service like Credit Karma or through your existing bank. Then research which cards typically approve applicants in your score range to target your application appropriately.

Strategic Debt Reduction Using Balance Transfer Cards

Now for the most important part—how to actually use a balance transfer card to crush your debt! This isn’t just about moving money around; it’s about creating a deliberate plan to become debt-free.

7 steps to becoming debt-free through strategic planning

Creating Your Balance Transfer Payoff Plan

Before you even make your first payment, you need a clear plan. Here’s my step-by-step approach:

-

Calculate your target monthly payment: Take the total transferred balance (plus any fees) and divide by the number of months in your promotional period. This is the minimum you should pay each month.

Example: $6,000 transfer with a $180 fee (3%) and 18-month term = $343.33 monthly payment

- Build this payment into your budget: Treat this payment as a non-negotiable—just like your rent or mortgage.

- Set up automatic payments: This ensures you never miss a payment, which could jeopardize your promotional rate.

- Create visual reminders: Put the payoff date on your calendar and create a visual debt tracker to watch your progress.

- Look for ways to make extra payments: Any windfalls, tax refunds, or expense reductions should go toward accelerating your debt payoff.

What to Do With Your Old Cards

This is a crucial decision point where many people go wrong! Once you’ve transferred a balance, you have an empty credit card with a high limit. What now?

DO:

- Keep the account open (to maintain your credit history length and total available credit)

- Remove the card from your wallet and store it securely

- Remove saved card details from online shopping sites

- Check the account monthly to ensure no fraudulent charges

DON’T:

- Close the account immediately (this can hurt your credit score)

- Start using it for new purchases

- Forget about it completely (leaving it vulnerable to fraud)

- Apply for new credit cards during your debt payoff period

Advanced Balance Transfer Strategies

For Larger Debt Amounts

If your debt exceeds what you can transfer to a single card, consider these strategies:

- Multiple card strategy: Apply for two different balance transfer cards and split your debt between them.

- Highest-interest-first approach: If you can’t transfer all balances, move the highest-interest debt first.

- Snowball after transfer: Transfer what you can, then use the debt snowball method for any remaining balances.

When the Promotional Period Ends

Have a clear plan for what happens when your 0% APR expires:

If you’ve paid off the balance:

Congratulations! Consider keeping the card for emergencies (but use it responsibly) or using it strategically for any rewards it offers.

If you still have a remaining balance:

- Evaluate whether another balance transfer to a new card makes sense

- Accelerate payments by cutting expenses or increasing income

- Consider whether a personal loan with a fixed rate might be better than the variable credit card rate

ACTION STEP

Create a simple, visual debt payoff tracker on your refrigerator or as the background on your phone. Each time you make a payment, update your tracker. Visualization is powerful motivation!

Balance Transfer Success Stories

I love sharing real-life stories because they remind us that becoming debt-free isn’t just a theory—it’s possible for anyone who approaches it with intention and discipline. Here are a few inspiring examples of people who have successfully used balance transfers as part of their debt-free journey:

Characteristics of people who successfully become debt-free

The Young Professional

“I graduated with $12,000 in credit card debt from my college years, spread across three cards with interest rates between 22-26%. After getting my first full-time job, I applied for a balance transfer card with 0% for 18 months. I transferred all my balances and committed to paying $700 per month—which was a stretch but doable with my new income. I set up automatic payments and lived on a strict budget. Fifteen months later, I made my final payment two months ahead of schedule! The best part? I saved over $3,000 in interest and learned valuable budgeting skills in the process.”

Savings: Approximately $3,200 in interest

The Debt-Snowballing Couple

“My husband and I had accumulated $28,000 in credit card debt after some medical emergencies. We couldn’t qualify for one card with a high enough limit to transfer everything, so we each applied for separate balance transfer cards—one with 0% for 21 months and another with 0% for 15 months. We transferred our highest-interest debts first and created a plan to pay off the shorter-term card first. After that was paid off, we redirected those payments to the second card. We cut all unnecessary expenses and sold items we didn’t need. We paid off both cards before their promotional periods ended and have stayed debt-free since!”

Savings: Approximately $6,800 in interest

The Serial Transferer Who Finally Broke Free

“I was caught in a cycle of transferring balances for years without making real progress on my $9,000 debt. I’d transfer to a new 0% card, make minimum payments, and then transfer again when the rate expired. This went on for nearly four years, and I was actually going deeper into debt due to transfer fees and occasional new purchases. The turning point came when I realized I needed to change my behaviors, not just my interest rate. I found a card with an 18-month 0% period, transferred my balance one final time, cut up ALL my other cards, and created my first real budget. I put every extra dollar toward that debt and picked up a side gig delivering groceries on weekends. It took 16 months, but I finally paid it off completely—and more importantly, I’ve stayed debt-free for two years now.”

Lessons learned: Balance transfers only work when combined with behavior change

Success Statistics

- According to a recent survey by Experian, 57% of consumers who use balance transfer cards successfully pay off their transferred balance during the promotional period.

- The average consumer who completes a balance transfer saves approximately $700-$1,000 in interest during the promotional period.

- Those who create a specific payoff plan before transferring are 3x more likely to pay off their balance before the promotional period ends.

ACTION STEP

Find an accountability partner who will check in with you monthly on your debt payoff progress. Share your specific monthly payment goals with them and ask them to hold you accountable.

Common Balance Transfer Pitfalls to Avoid

While balance transfers can be powerful tools for debt reduction, there are several common mistakes that can derail your progress. Let’s talk about what to watch out for and how to avoid these pitfalls.

:max_bytes(150000):strip_icc()/Balance-transfer-fee_final-4a50b3eed4374262999696e1bb893ef9.png)

Understanding balance transfer fees and potential pitfalls

The 7 Balance Transfer Traps

1. Continuing to use your old cards

Perhaps the most dangerous pitfall—transferring your balance but then racking up new debt on the newly available credit line. This can leave you in worse shape than when you started!

2. Only making minimum payments

If you only make minimum payments during the promotional period, you’ll end up with most of your balance still remaining when the high interest rate kicks in.

3. Missing the transfer window

Many cards only allow transfers at the promotional rate for the first 60-120 days. Missing this window means you’ll pay the regular (high) APR on any transfers made later.

4. Making a late payment

A single late payment can cause you to lose your promotional rate immediately! Most card agreements include this provision, and the regular APR will apply to your remaining balance.

5. Not accounting for the transfer fee

A 3-5% fee might not seem like much, but on a $10,000 balance, that’s $300-$500 added to your debt right away. Make sure to factor this into your payoff calculations.

6. Using the card for new purchases

Many balance transfer cards have different terms for purchases vs. transfers. Your payments might apply to transferred balances first, leaving purchases accruing interest at the regular rate.

7. Becoming a serial balance transferer

Some people get caught in a cycle of repeatedly transferring balances without making progress on the underlying debt. This can damage your credit score and cost you in repeated transfer fees.

The Fine Print You Must Read

I know, I know—nobody likes reading the fine print! But there are a few specific things you absolutely must check in your card agreement:

- Balance Transfer Time Limit: How long do you have to make transfers at the promotional rate?

- Payment Allocation: How are payments applied if you have different types of balances (transfers vs. purchases)?

- Penalty Triggers: What actions could cause you to lose your promotional rate?

- Rate Change Notifications: How will you be notified when your promotional period is ending?

- Balance Transfer Restrictions: Some cards don’t allow transfers from cards issued by the same bank or financial institution.

Balance Transfer Safety Checklist

- Set up automatic payments for at least the minimum due (but preferably your target monthly amount)

- Create calendar reminders for when the promotional period ends

- Remove all transferred cards from your wallet and online shopping accounts

- Check your statements monthly to ensure transferred balances are being paid down

- Track your progress consistently against your payoff plan

ACTION STEP

Write down your “why” for getting out of debt and post it somewhere you’ll see daily. On tough days when you’re tempted to spend, this reminder of your bigger purpose will help keep you on track.

Frequently Asked Questions

Will a balance transfer hurt my credit score?

A balance transfer may cause a temporary dip in your credit score due to the hard inquiry and new account, but the long-term effect is usually positive if it helps you pay down debt. The lower credit utilization that results from having more available credit can actually improve your score over time.

Can I transfer different types of debt to a balance transfer card?

While balance transfer cards are primarily designed for transferring credit card debt, some issuers allow transfers from other types of loans using convenience checks. However, this varies by card issuer, and personal loans or auto loans may not qualify for the promotional rate.

What credit score do I need for the best balance transfer offers?

The most competitive balance transfer offers typically require a good to excellent credit score (670+). However, some balance transfer options are available for those with fair credit (580-669), usually with shorter promotional periods or higher fees.

Is there a limit to how much I can transfer?

Yes, the limit is usually determined by your approved credit limit on the new card, minus the balance transfer fee. For example, if you’re approved for a $10,000 limit and there’s a 3% transfer fee, you could transfer up to approximately $9,700.

Can I transfer a balance from any credit card?

Generally, you cannot transfer balances between cards from the same issuer. For example, you can’t transfer a balance from one Chase card to another Chase card. You’ll need to transfer to a card from a different bank.

Should I close my old credit card after a balance transfer?

It’s usually better to keep the old account open but not use it. Closing credit accounts can reduce your total available credit and shorten your credit history, potentially lowering your credit score. If the card has an annual fee, however, you might consider closing it.

What happens if I can’t pay off the balance during the promotional period?

Any remaining balance will start accruing interest at the regular APR when the promotional period ends. This rate is typically quite high (often 16-29%), so it’s important to pay off as much as possible during the 0% period or consider another balance transfer before the promotional rate expires.

Final Thoughts: Your Debt-Free Future

The path to achieving financial freedom through debt reduction

Balance transfer credit cards can be powerful tools in your journey toward financial freedom—but they’re just that: tools. The real power comes from your commitment to changing your financial habits and making intentional choices every day.

Remember that debt is not just a financial issue—it’s an emotional and spiritual one too. When we’re weighed down by debt, it affects every area of our lives. But there’s something incredible that happens when you start to see that debt balance shrinking month after month. You begin to feel lighter, more hopeful, and more in control of your future.

“The borrower is slave to the lender, but freedom comes not just from paying off debt—it comes from changing your relationship with money altogether.”

As you work your balance transfer plan, don’t just focus on the numbers—celebrate the new habits you’re creating. Each payment you make is a step toward the life you want—a life where your income is yours to save, give, and enjoy rather than being promised to creditors.

I believe in you! With focus, discipline, and the right tools at your disposal, you can absolutely become debt-free and build a legacy of financial peace.

Your Next Steps

- Assess your current debt situation and determine if a balance transfer is right for you

- Check your credit score to see which cards you’re likely to qualify for

- Compare specific offers based on your transfer amount, fees, and promotional periods

- Create your debt payoff plan BEFORE applying for any card

- Set up systems to ensure success—automatic payments, visual trackers, and accountability

Remember, a balance transfer is not an ending—it’s a beginning. The beginning of your journey to true financial freedom!

Copyright © 2025. No copyright infringement is intended. All images used are copyright-free or used under Creative Commons licenses with proper attribution.